Swiss Companies and the New Silk Road

- KOF Bulletin

- World Economy

Many companies hope that the Chinese infrastructure project will bring them new business opportunities, among them also Swiss companies. While the associated economic potential is enormous, so are the uncertainties and challenges. An overview in four points.

The Chinese Belt and Road Initiative (BRI), or New Silk Road, aims to strengthen economic links between China and Africa, Asia, Europe, Latin America and the Near East. According to official documents, the goal of the BRI is to promote a wide variety of different areas including political coordination, infrastructure, financial integration, industrial cooperation and human relations.

Devising a Swiss strategy and concrete responses to this dynamic and multidimensional initiative is a challenge. The opportunities the new Silk Road offers the Swiss economy were discussed at the recent KOF Wirtschaftsforum. For the first time, the discussion also touched on the memorandum of understanding (MoU) on cooperation in third countries issued by the People’s Republic of China and Switzerland and signed by Federal President Ueli Maurer in April. Four key insights can be derived from this debate and the current state of knowledge.

1. The geographical scope of the New Silk Road is unclear.

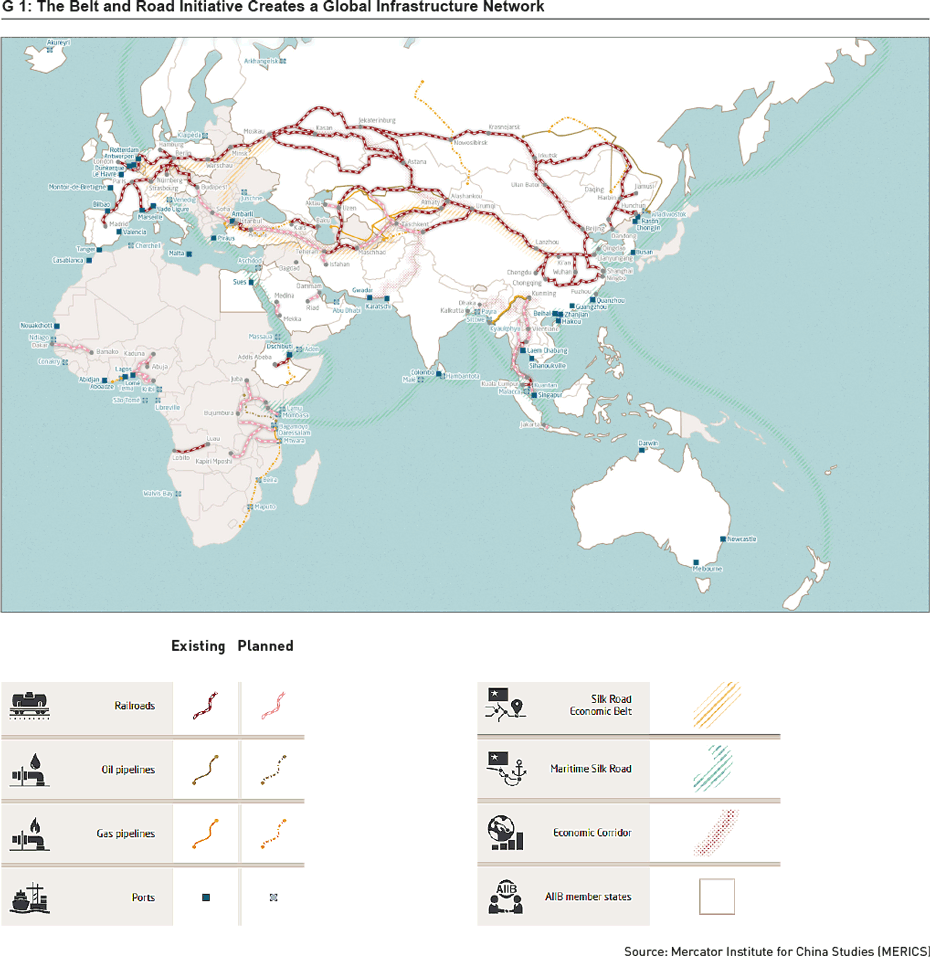

The New Silk Road, a long-term Chinese initiative with global reach, has a flexible shape in terms of geography and content. As yet, the People’s Republic of China has failed to publish an official Belt and Road map or list of countries involved. As a consequence, various BRI plans and estimates of current and planned investments are making the rounds. Official documents refer to six land corridors and one maritime link. Recently, an arctic corridor has also been mentioned. The following graph G x illustrates possible routes for the planned links and those that have already been realised.

On the one hand, one can refer to the 125 states, which have signed some form of MoU with China, as BRI countries. On the other hand, a geographical approach can be used, as chosen by the World Bank, which mentions 70 BRI corridor states (not including China) that are located along one of the six land routes or the Maritime Silk Road and are either already involved in BRI projects or plan to do so. The estimated current and planned investments in infrastructure projects amount to CHF 550 billion (World Bank 2019).

2. The economic potential of the New Silk Road is enormous – as are the challenges.

The infrastructure demand in emerging countries and regions is immense. According to the Asian Development Bank, Asia alone lacks CHF 1,660 billion in infrastructure investment every year. The World Bank estimates that the full implementation of all planned BRI transport infrastructure projects would raise the global trade volume by 1.7 to 6.2%. Global income could rise between 0.7 and 2.9%. On top of this, the World Bank estimates that the projects have the potential to lift over 7.6 million people out of extreme poverty.

To tap this growth potential, according to the World Bank, BRI countries must implement complementary policy measures. Central aspects consist of enhanced legal security, higher transparency – for instance with regard to Chinese loans and project awards –, lower trade barriers and guaranteed non-discriminatory use of the infrastructure in transit countries. At the second Belt and Road Forum in late April, China’s President Xi Jinping announced that the BRI would be more «green, clean and transparent» in the future.

3. Individual sectors of the Swiss economy have the opportunity to get involved in BRI projects.

BRI projects can offer Swiss companies opportunities in various forms. Firstly, through Swiss companies’ direct or indirect participation in BRI infrastructure projects. However, due to the currently intransparent tender system, direct participation appears difficult. According to the Center for Strategic and International Studies (CSIS), until January 2018, close to 90% of the BRI contracts were being carried out by Chinese corporations. At the KOF Wirtschaftsforum, emphasis was placed on the central importance of a global information portal for project tenders with uniform technology and standards. Furthermore, participants requested the government to advocate favourable framework conditions and compliance with international environmental and social standards in BRI projects.

The option of Swiss companies’ indirect participation in BRI projects appears more promising. Such opportunities are mainly open to companies which are already established suppliers of Chinese state-owned corporations. The creation of specific Swiss consortia should be investigated in order to increase opportunities for Swiss companies. This could help SMEs in particular to enter global value chains. Swiss financial institutions could fund such industrial consortia and the Swiss Export Risk Insurance (SERV) could insure any political risks.

The BRI probably offers the largest potential to Switzerland’s financial industry. Swiss financial institutions could act as lenders and investors. At the Wirtschaftsforum, referring to long-term investors, the re-insurer Swiss Re emphasised that infrastructure projects require a liquid market. After all, Swiss insurance groups could also (re)insure specific infrastructure projects.

Secondly, Swiss companies are likely to profit in the medium to long-term from the positive growth impetus provided by the planned infrastructure projects. In this respect, China’s initiative focuses on the massive infrastructure challenges in Asia and other emerging countries and regions. In certain corridor countries, the investments made by Japan and the Asian Development Bank are already more significant than the projects planned in the BRI context. In addition, several countries and confederations of states have announced bilateral infrastructure initiatives, among them the EU, South Korea and Russia.

Thirdly, enhanced infrastructure could change trade routes in the medium term, which would reduce trading costs and make global value chains more efficient.

4. A new need for coordination and cooperation has arisen on the Swiss side.

In their jointly signed memorandum of understanding, China and Switzerland express their willingness to identify opportunities for cooperation on projects in third countries in the fields of trade and financial services as well as general infrastructure investments. Furthermore, they plan to exchange project information. The MoU also sets out the principles for cooperation in third countries: The projects must respect international standards and should be market- and enterprise-based. On top of this, they should be designed such that they contribute to the achievement of the UN sustainability goals.

The MoU mentions three cooperation platforms for BRI projects, two of which are to be primarily organised by the private economy. The role of the government is still to be defined. At the Wirtschaftsforum, emphasis was repeatedly placed on the essential role played by the federal administration in all cooperation agreements with China. Hence, Switzerland must get organised and stay up-to-date with regard to other western countries’ activities in the BRI context. After all, Switzerland is not the only country to have signed a memorandum of understanding with China.

Contact

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland