SNB Under Pressure

- Monetary Policy

- KOF Bulletin

With big central banks once again focussing on more expansive monetary policies, the Swiss National Bank is under pressure to act. In response, the Bank could further reduce the key interest rate or step up its foreign currency purchases – which may, however, lead to problems with the USA. KOF expects a cut in key interest rates.

At its last two meetings, the US Federal Reserve (FED) reduced the key interest target band to currently 1.75% - 2% in response to international uncertainty. The European Central Bank (ECB) has also eased its monetary policies. In specific, the ECB Council decided to cut the deposit rate of interest by 10 basis points to -0.5%. At 0%, the main refi rate was not changed.

The expansive monetary policies pursued by the big central banks continue to put pressure on the Swiss National Bank (SNB). Following the introduction of negative interest, the interest differential to the eurozone has remained constant over the last three years. Together with foreign exchange market interventions, this has at least stabilised the exchange rate. Since the monetary easing of the ECB had been anticipated, the lowering of the interest differential by the ECB did not result in a further appreciation of the Swiss franc, although pressure may well rise in the medium term due to current global uncertainty.

Three currency manipulation criteria

In response, the SNB could further lower the key interest rate in the negative range or raise its foreign exchange purchases. However, this might lead to political upheavals due to the 2015 US “Trade Facilitation and Trade Enforcement Act”. This act forms the legal basis for the identification and sanctioning of countries which, from the US perspective, are manipulating their currency to their own advantage.

A country’s behaviour is considered unfair when the following three criteria are met:

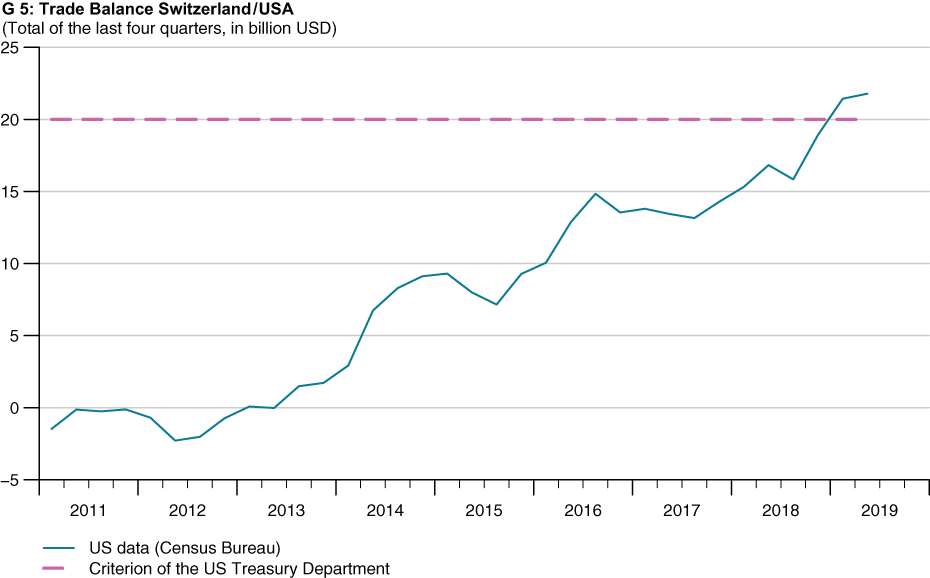

1. The balance of trade in goods between the country and the USA has shown a surplus of over USD 20 bn over the last four quarters. At least this year, Switzerland has been significantly above this threshold, as Graph G 5 (Trade Balance) shows. With a trend reversal not on the cards, it is very likely that this criterion will be met in the future.

2. The current account surplus makes up more than 2% of the gross national product (GDP) - a figure that a small and open country like Switzerland easily outstrips at 10%.

3. Total net foreign exchange purchases during the last twelve months do not exceed 2% of GDP, while interventions have taken place in at least six of twelve months. Given estimated purchases of around CHF 10 bn in the last three months alone, this threshold is also just around the corner. Of course, the frequency, or chronological distribution, of the coming interventions would be crucial.

According to the Trade Facilitation and Trade Enforcement Act, the US President should initiate bilateral negotiations and submit policy suggestions. If the implementation of these suggestions is unsatisfactory after a period of one year, future trade agreements would most likely be sabotaged, and further measures by the US government could not be excluded.

KOF expects cut in Swiss key exchange rates

Since the first two criteria have been all but met on a structural basis this year, the SNB could adjust the frequency and amount of its money market interventions to the US act to avoid jeopardising Switzerland’s trade relations. However, such a potential restriction of monetary autonomy could result in a loss of credibility, which, in turn, would probably put pressure on the Swiss franc.

Given this background and the ECB's anticipated negative interest rate adjustment at the end of the year, KOF expects the SNB to follow suit and reduce key interest rates until the end of the year to stabilise the interest differential with the eurozone. Both the moderate forecast for the Swiss economy and the sluggish price trend support this scenario.

In addition, the SNB has recently raised the allowance on current account balances held with the SNB, which substantially reduces the banks’ payments. Adjustments of the allowance for purposes of controlling the negative interest burden should thus be seen as an additional instrument that gives the SNB fresh room for manoeuvre. In other words, the national bank could reduce the negative interest rates even further without raising the banks’ SNB deposit burden above the level of the last few years.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland