KOF Business Tendency Surveys for April 2020: a historic challenge for service providers

- KOF Business Situation Indicator

- Business Tendency Surveys

- KOF Bulletin

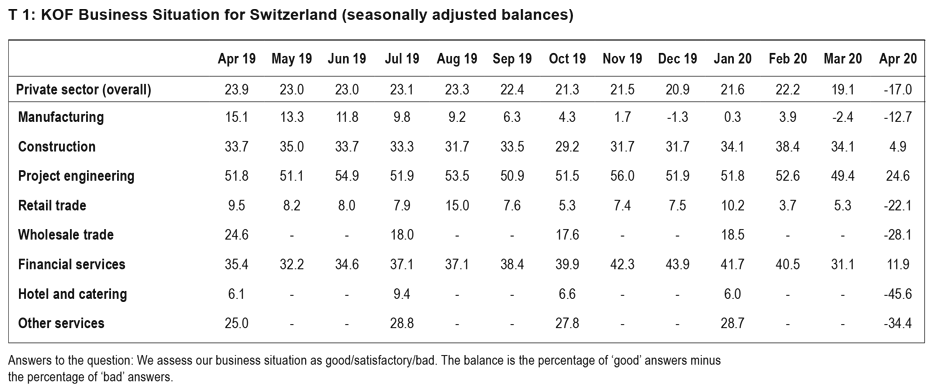

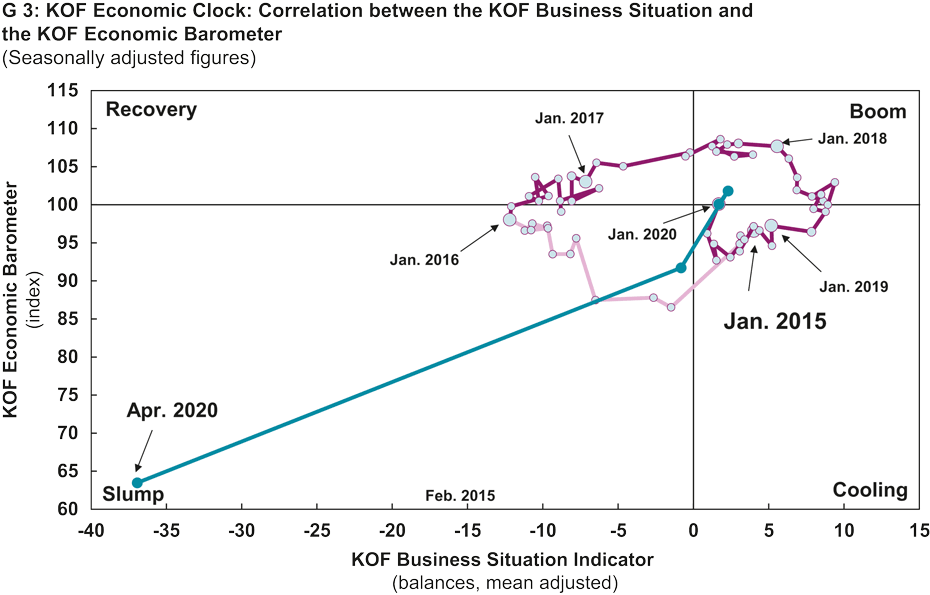

The KOF Business Situation Indicator fell extraordinarily sharply in April. In the face of the COVID-19 pandemic, companies reckon that their business is faring even worse than during the 2009 financial crisis. Specially added questions on the pandemic indicate that the slump in demand is more serious than restrictions on production.

KOF Business Situation Indicator (updated regularly)

The COVID-19 pandemic is hitting all sectors of the economy hard. Nevertheless, the exact situation varies from one sector to another. Manufacturing industry continues to draw some benefit from its encouraging performance in the first few months of this year. Despite a sharp downward correction the business situation here is not yet as bad as during the financial crisis of 2009 (table 1), although the demand and production outlook for the near future is very negative. In the construction industry and at project engineering firms the Situation Indicator is falling more sharply than ever before month on month. Nevertheless, the adverse business situation is not predominant here; at least as many companies are reporting a healthy situation as a bad one. The same applies to the financial sector.

In the hospitality and retail sectors the Business Situation Indicator has collapsed and the situation is very difficult. However, other service providers are also facing a historic challenge. Overall, business in this sector is faring significantly worse than during the financial crisis.

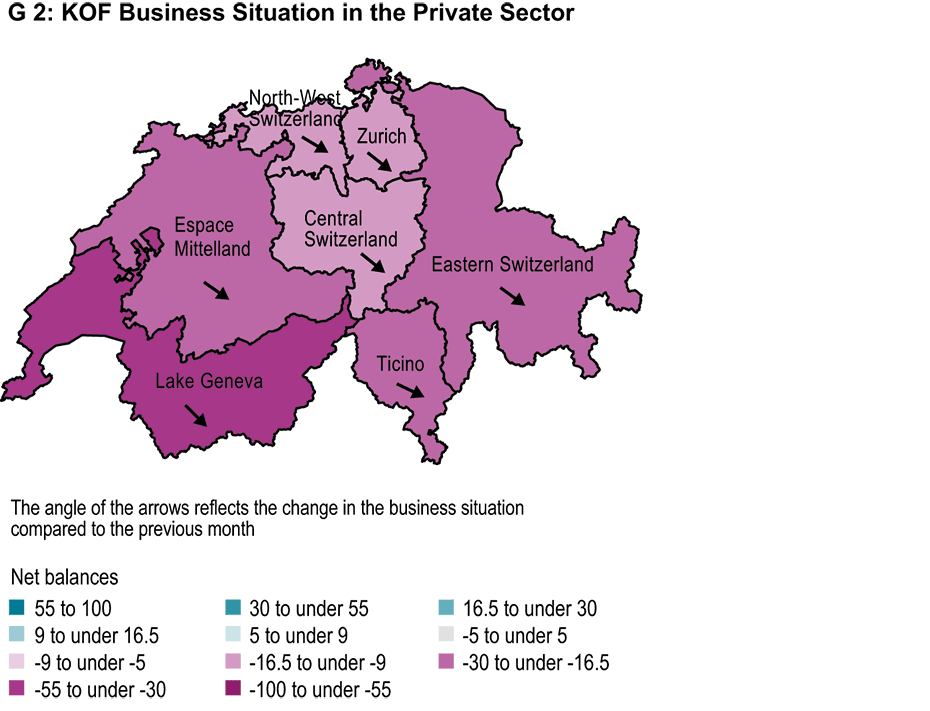

Responses to specific questions from selected sectors indicate that the slump in demand is considered to be more serious than restrictions on a company’s own production or service provision owing to staffing restrictions or a lack of preliminary products. Moreover, companies in Italian-speaking and French-speaking parts of Switzerland are reporting adverse effects significantly more frequently than firms in German-speaking parts of the country (Chart 2).

Manufacturing is drawing some benefit from its encouraging start to the year

The Business Situation Indicator for manufacturing industry has fallen significantly. However, the situation is currently not as challenging as it was during the 2009 financial crisis, and companies are likely to continue to benefit somewhat from their strong performance in the first two months of this year. Nonetheless, new orders are likely to come in only infrequently. The outlook for incoming orders in the near future is gloomier than during the financial crisis. The same applies to production plans.

Responding to a specially added question on the demand-related effects of the COVID-19 pandemic, 51 per cent of companies stated that demand was significantly reduced. However, the chemical and pharmaceutical industry is somewhat of an exception here and is complaining much less often about a sharp drop in demand. The restrictions that companies see in the organisation of their own production processes are also considerable, but not as pronounced as the demand-related problems. 12 per cent of companies state that the availability of preliminary products, operating materials and so on is a major constraint. These complaints are particularly pronounced among manufacturers of textiles, clothing and footwear. In addition, companies in French-speaking and Italian-speaking parts of Switzerland are complaining about such restrictions more frequently than those in German-speaking parts of the country. This regional pattern also applies to the issue of staff deployment: companies in French-speaking and Italian-speaking parts of Switzerland are reporting more often than companies in German-speaking areas that there are severe restrictions because staff cannot be deployed.

The retail and wholesale sectors expect no improvement in the near future

In the retail trade, conventional business has come to a standstill in many segments. Accordingly, the Business Situation Indicator has fallen to its lowest level in more than 15 years. A stable sales trend is expected for food. Otherwise, the sales outlook is very negative overall. Earnings have already collapsed, and goods are piling up in the warehouses. Nevertheless, retailers are hoping at the moment that no downward spiral in selling prices will be triggered. The situation in the wholesale trade is also considerably less encouraging than at the beginning of the year.

Responding to the specially added question on pandemic effects, 55 per cent of wholesalers are already reporting that their sales of goods have been significantly reduced. 28 per cent of wholesalers report that the availability of goods is severely impaired. Overall, the wholesale trade expects demand to fall in the near future. This assessment is particularly pronounced in the wholesaling of producer goods. The demand outlook for the wholesale trade in consumer goods is also negative.

The business situation in construction is also deteriorating sharply

Business in the project engineering and construction sectors is slowing very sharply. Consequently, the business situation in the construction industry is considered to be less encouraging than at any time since 2004 – after a monthly decline on an unprecedented scale. Despite this extreme correction, however, a seasonally adjusted 77 per cent of companies still rate their current business situation as either good or satisfactory. 23 per cent of construction companies reckon their situation is bad. This means that the construction industry is still in a relatively strong position compared with other sectors. However, construction output is likely to decline substantially in the coming months.

The hospitality industry has been devastated by the pandemic

After business in the hospitality sector had been fairly stable for almost two years, the coronavirus has brought it to its knees. Tourism is very limited and in many places has come to a complete standstill. In response to the specially added question on the impact of the pandemic on business activity, almost all accommodation providers and all food service providers say that it has been significantly reduced. At the moment, these providers see no hope of any improvement. The demand outlook is clearly negative.

Business in financial and insurance services continues to decline

Business in financial and insurance services slowed noticeably as early as March against the background of sharp corrections in financial markets. In April this downward trend continued. Banks also consider their situation to be much less encouraging than at the beginning of 2020. On the one hand, they expect a significant increase in lending business with corporate customers. This will be boosted by the government's support measures, as these institutions reckon that the creditworthiness of corporate customers has deteriorated considerably. On the other hand, they expect to see slower growth in lending business with private customers.

Service providers are suffering greatly from the pandemic

The Business Situation Indicator for other services has fallen sharply. These service providers are facing a historic challenge: the situation is significantly worse than it was during the 2009 financial crisis, demand has already plummeted and service companies are highly pessimistic about the level of demand going forward.

In response to the additional question about the explicit demand effect of the pandemic, 55 per cent of companies state that demand for their services has declined significantly. Moreover, the weakness of demand is affecting large parts of the sector. The demand outlook is more negative than during the financial crisis, both in the sub-sector of transport, information technology and communications and in personal and business services. Complaints about the pandemic are particularly pronounced in the arts, entertainment, recreation, transport, warehousing and other business services sectors, which include travel agencies, temporary employment agencies and gardening and landscaping.

You can find the detailed results of the KOF business surveys Downloadhere (PDF, 154 KB)vertical_align_bottom.

Graphics and tables can be found Downloadhere (PDF, 293 KB)vertical_align_bottom.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland