KOF Investment Survey: Companies Set to Expand Investments

- KOF Bulletin

- Surveys

The results of the latest KOF Investment Survey indicate a rise in total investment in 2016. According to the companies, there will be an approx. 4% expansion of investment activities this year. The results of the Spring Investment Survey 2016 thus confirm the outcome of the last survey in autumn 2015.

The Investment Survey conducted in spring 2016, which has now been concluded, provides the second set of investment figures for 2016. Last autumn, the respondents already stated their evaluation of expected investment activities in 2016. At the time, they anticipated an increase of around 3%, predominantly driven by industry and the services sector. The current results show little change in the companies’ expectations. According to the current survey results, companies anticipate a slight rise in investment dynamics of approx. 4% this year. Once again, with increases of 3% and 6% respectively, industry and the services sector will be mainly responsible for this expansion. The current results of the KOF Investment Survey of Spring 2016, which was conducted among over 2,700 enterprises, also indicate that the companies expect dynamics to slow down slightly in 2017.

Industry and services drive gross investment

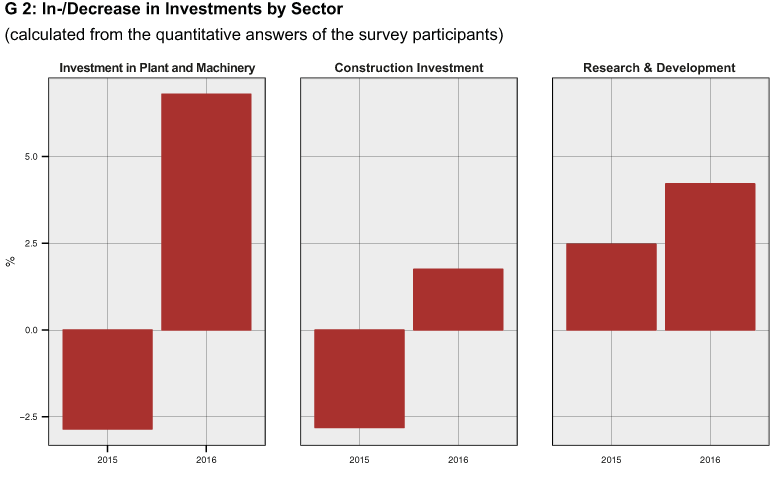

This year, strong signs of life are expected from the industrial sector. Compared to last autumn, the respondents anticipate a slightly stronger increase in gross investment of around 3% this year (autumn: 2%). In this context, construction investment is likely to rise by 2% while investment in plant and machinery may even grow by up to 5% (see G 2). The biggest increase is expected in the wood, glass and ceramics sector, with construction investment set to grow fastest. Textile manufacturers and companies in other industries reported the biggest anticipated decline in investments. The chemical and pharmaceutical industries are set for a slight increase, while the metal and engineering industries are planning slightly lower investments.

Aside from the industrial sector, the tertiary sector will also play an important role in raising macroeconomic private investment. Similar to last autumn, the service companies taking part in the survey expect a close to 6% increase in gross investment in 2016 (autumn: 5%). Insurance companies are the most investment-friendly, although companies providing B2B business services and transport companies also report a significant increase in their gross investment plans for 2016. In contrast, retailers and communications companies are planning to cut investments this year. The construction sector is less optimistic than the industrial and service sectors where investment activities in 2016 are concerned. According to the respondents, gross investments in 2016 are likely to be 6% lower than last year. The decline is mainly due to the main construction trades, while the finishing trade is envisaging an expansion of investment in the current year.

Swiss companies anticipate slight devaluation

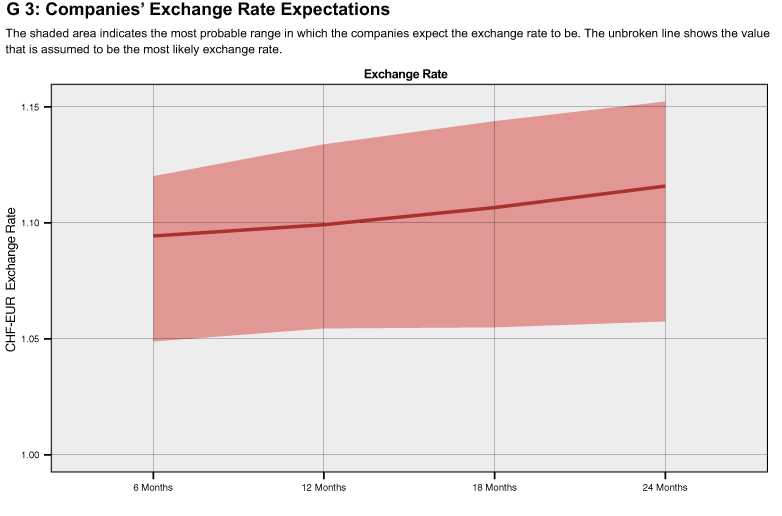

After the suspension of the minimum CHF-EUR exchange rate, a question regarding the future development of the exchange rate was included in the KOF Investment Survey. In this context, KOF quizzes the companies as to their subjective exchange rate expectations. The companies are asked to state the upper and lower limit of a target range in which the CHF-EUR exchange rate will most likely be in the coming 6, 12, 18 and 24 months. Subsequently, the companies are asked to indicate the figure within the range they consider most likely.

According to the current survey results, the companies expect a CHF-EUR exchange rate of around 1.10 in the coming two years (see G 3). However, all in all, the average expectations show a slight downward tendency. While the companies anticipate an exchange rate of 1.095 in six months, their estimate in two years is a slightly weaker Swiss Franc with an average exchange rate of around 1.115. On the whole, the companies’ expectations are dominated by significant insecurity. The average limits of the target ranges stated by the companies indicate expectations of an exchange rate between 1.06 and 1.15 in two years’ time.

Contact

No database information available