KOF Autumn Forecast 2016: Back to Moderate Growth

- KOF Bulletin

- KOF Economic Forecasts

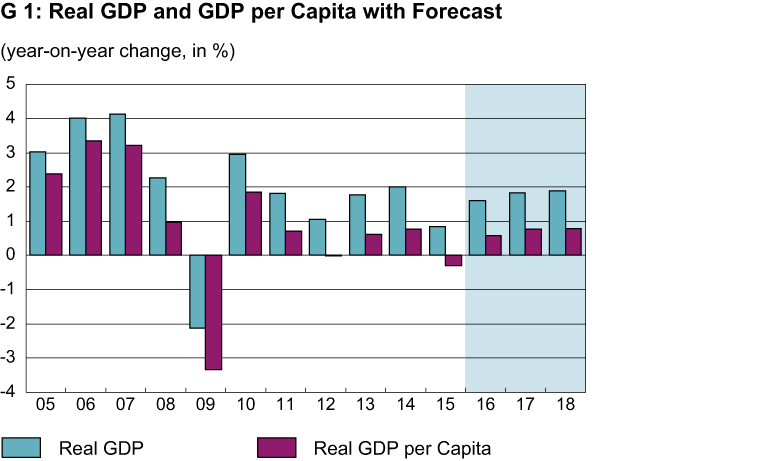

After a dry spell, the Swiss economy is slowly picking up speed (see G 1). Growth is increasingly driven by merchanting, while the other sectors – excluding retail – are moving sideways. Investments remain on the low side. The labour market is recovering gradually and inflation is still low.

International environment

In the coming months, KOF expects a moderate expansion of the global economy. Emerging markets will make the biggest contribution towards growth. However, in the course of China’s structural change, the country’s growth figures will become successively smaller. In contrast, the economic upturn in India should remain solid. Assuming stable political developments and robust commodity prices, Russia and Brazil are expected to make positive contributions as of next year. The global economy remains prone to further crises. In many countries, debt levels are significantly higher than before the big recession, leaving little leeway for further support measures. Combined with limited possibilities of further quantitative easing, this makes it difficult for governments to play a supportive role in the event of disturbances.

Development in Switzerland

Two years after the Swiss franc shock, pressure on companies to optimise or streamline operational processes remains

high in Switzerland. The Swiss franc / euro exchange rate has been relatively stable for a year now. The current level is somewhat more acceptable than in the first weeks after the Swiss National Bank’s (SNB) suspension of the minimum exchange rate. Fresh turbulence on the foreign exchange markets, for instance after the Brexit vote, have not resulted in a further revaluation. However, this was probably largely due to intervention by the SNB.

Switzerland has recorded trade surpluses for many years, due initially to trade in services, in particular in the financial sector. For over 10 years now, the traditional commodity trade has also generated surpluses, and merchanting, which has become an additional source of income, has made a substantial contribution to the trade surplus in the same period. Merchanting is part of the wholesale trade and the driving factor behind the latter’s growing contribution to added value. In the period from 1997 to 2014, the wholesale share rose from seven per cent to approximately 10 per cent.

Rewriting the past

Compared to the State Secretariat for Economic Affairs (SECO) initial estimates of last year’s economic development, which assumed a weaker trade performance, the 2015 industry trends have been turned upside down. Although KOF had anticipated an upward revision of trade figures in summer 2016, it had also expected an increase in the GDP growth rate. As it turns out, industry was hit much harder by the revaluation than anticipated. At 3.1 per cent, the nominal increase in added value in the industrial sector was in the range of the initial SECO estimate. However, at 2.2 per cent, the decline in prices in the industrial sector was substantially smaller than the initial estimates of 5.5 per cent. Previous assumptions that industry was raising production volumes by 3 per cent while accepting major declines in margins had to be revised. According to the Federal Statistical Office (FSO), production actually declined by 0.9 per cent, thus contributing –0.2 percentage points to GDP growth. Banks, however, recorded the most significant setback (–9%), delivering a negative contribution to growth of 0.5 percentage points.

Sluggish labour market recovery

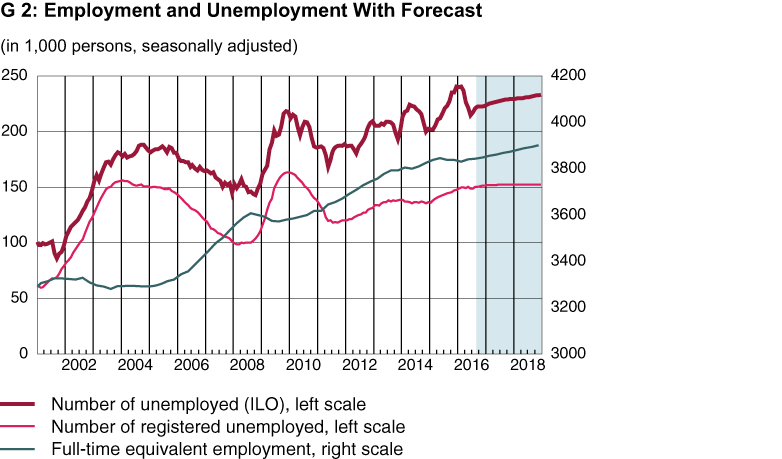

This year, Switzerland’s labour market situation was dominated by the repercussions of last year’s economic slowdown. The last few quarters did not come close to the healthy employment growth recorded in recent years. Consequently, unemployment went up. Immigration has also been lower in the last few quarters. The signals sent by leading indicators and hard labour market figures are

ambiguous. It is true that numerous leading indicators have bottomed out in the last few weeks and months and are showing a slight upward trend. For the second half of the year and the coming year, this would indicate a slow recovery of the labour market from the dent left behind by the Swiss franc shock. However, the majority of the indicators remain at a rather low level. On top of this, the sluggish global economic trend, subdued consumer sentiment and structural problems in certain sectors – for instance low profitability in some industrial sectors and the banking sector – are likely to place a strain on the employmentdevelopment. Due to the slow pace of employment growth, unemployment figures are not decreasing much. Seasonally adjusted, registered unemployment – i.e. the unemployment rate according to SECO – will probably average 3.3 per cent this and 3.4 per cent next year. The unemployment rate according to the International Labor Organization (ILO) is also likely to remain stable, hovering at 4.6 per cent in the current and in the following year (see G 2).

Subdued consumer mood

Growth in consumer spending is likely to remain moderate in the coming quarters. According to SECO’s Consumer Climate Index, consumers remain sceptical; the index has been stagnating below its long-term average for one year now. All in all, real disposable income should grow by 1.3 per cent this year while employment (in full time equivalents) is likely to stagnate. On an annual basis, private consumption will rise by 1 per cent in 2016 and 1.2 per cent in 2017.

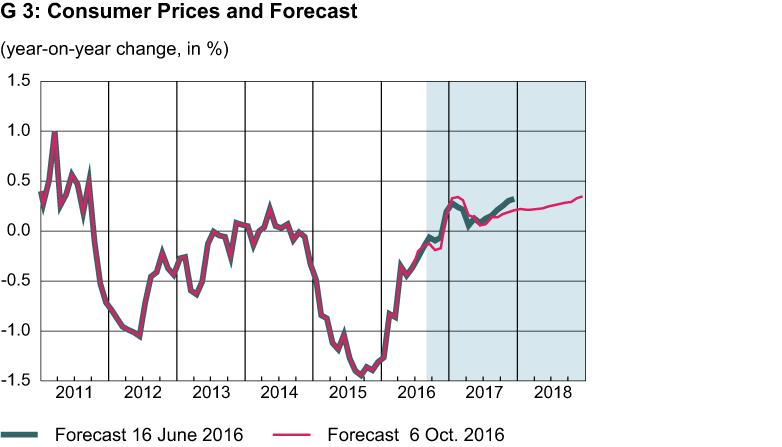

Price history since the beginning of 2015 has been dominated by adjustment to the new exchange rate reality. Based on the national consumer price index, year-on-year inflation had edged up closer to zero in August. This was also due to the last few months’ stabilisation of the oil price at just under 50 US dollars. Hence, the inflation forecast for 2016 remains at –0.4 per cent. However, due to the expected weak development in nominal wages and the below-average development of rents, inflationary pressure will stay low. In the coming year, KOF anticipates a slightly positive annual inflation rate of 0.2 per cent and in 2018 slightly higher inflation of 0.3 per cent (see G 3).

Construction investments recover, non-recurrent factors dominate investments in plant and machinery

At present, investment propensity in the private economy is restrained, with the biggest impulses in the construction industry coming from the public sector. Due to the subdued development in the first two quarters, KOF expects a stagnation in the construction industry this year. Nevertheless, financing terms remain attractive and the economic environment is steadily improving. Thanks to the positive fundamental data and substantial investment in hospital and infrastructure developments, the construction investments will recover in the coming year and record a plus of 1.2 per cent. In the near future, investments in plant and machinery will be dominated by the delivery of railway vehicles and aircraft that were ordered longe time ago. Once the non-recurrent factors have expired, investments in plant and machinery will decline by 0.4 per cent next year and pick up in 2018.

External trade: pharma industry drives export growth

Given the solid growth in exports in the first half of 2016, it would appear at first glance that the Swiss export sector has digested last year’s Swiss franc shock. However, export growth in the past quarters was not supported equally by all sectors: The gains recorded in the commodity trade are almost exclusively due to the solid growth of pharmaceutical exports. Following last year’s major setbacks, trade with the EU countries, which remain Switzerland’s main export markets, is perking up. Hence, KOF is anticipating a diffident trend in exports in the second half of the year. A wider-ranging export recovery is not expected before next year, involving growth rates of 2.3 per cent in 2017 and 3.6 per cent in the subsequent year. In terms of imports, KOF projects a weak development. Imports of goods and services are not likely to increase before next year. This trend is buoyed up by the positive export development as well as additional imports of capital goods.

You can find detailled figures of the latest KOF Economic Forecast here.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland