CTR III: Impact on the Economy and the National Budget

- Fiscal Policy

- KOF Bulletin

In mid-February, Swiss citizens will vote on the third corporate tax reform (CTR III). KOF researchers have investigated its impact on gross domestic product, investment, employment, consumption and tax revenue. They have found that there are positive effects for the economy despite the tax revenue shortfall generated by the reform.

Switzerland, a small open economy, depends to a large degree on migration, trade and international capital flows. Given the increasing mobility of companies and Switzerland’s low tax rates in international comparison, the number of enterprises choosing Switzerland as their domicile has grown significantly in the last few years. Special tax regimes offered by the Swiss cantons, for instance, provide competitive tax conditions for holding companies. These special cantonal tax regimes are based on the principle of lower tax on income generated abroad than on income generated in Switzerland.

New fiscal measures compensating for the scrapping of the special tax regimes

This form of discriminating taxation has become subject to growing criticism from the European Union (EU) and the Organisation for Economic Cooperation and Development (OECD). Pressure to scrap the special tax regimes and replace them with an internationally acceptable taxation system has prompted the authorities to launch a third corporate tax reform (CTR III), which was passed by Parliament in June 2016. On 12 February 2017, the Swiss population will vote on this reform in a referendum.

The law passed by Parliament provides for the abolition of the current special cantonal tax regime. In addition, as partial compensation for the higher taxes payable by some companies, but also as an innovation incentive, the law proposes the introduction of a license box system that reduces taxes on income from intellectual property rights, for instance patents. Furthermore, the new law allows the cantons to introduce an allowance for excess corporate equity that goes hand in hand with an obligation that at least 60 per cent of dividends should be subject to taxation at the cantonal level. Finally, the reform provides for a reduction of the cantons’ ordinary tax rate on earnings. This last measure, however, is not part of the referendum and will be decided individually by each canton.

Impact of the individual reforms

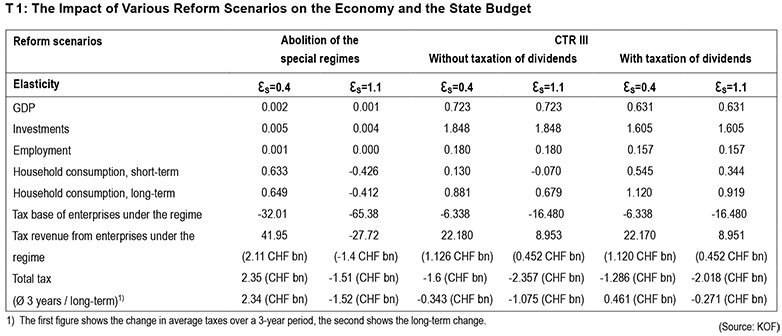

In a recent study, KOF researchers investigated the impact of CTR III on the economy and the national budget (Chatagny et al., 2016). The authors of the study calculated three different scenarios (see T 1) to determine the effects of various fiscal reforms on the economy and the national budget. In the first scenario (first and second column), the special tax regimes are abolished without any compensation. The SPCs (Special Purpose Companies) tax base therefore drops by 32 per cent, while the tax revenue rises by approximately 2.4 billion Swiss francs due to higher taxation of income remaining in Switzerland. Assuming an elasticity of 1.1 , the tax base drops by 65 per cent and the tax revenue by 1.4 billion Swiss francs, both in the short and the long run. In this scenario, private household consumption permanently declines by approximately 0.4 per cent.

Second scenario (third and fourth column): A license box system and the allowance for excess corporate equity are combined with a mean reduction of cantonal tax rates of 5 percentage points. The results show that CTR III can limit the shift abroad of the SPCs tax base to -6.3 per cent when the elasticity factor is 0.4 and to -16.5 per cent when the elasticity is 1.1. While the short-term effect on private consumption is slightly negative if the elasticity factor is 1.1, the long-term effect is positive irrespective of the elasticity. In addition, the reform has a positive impact on the real economy, resulting in an increase in GDP of 0.7 per cent, in investment of 1.8 per cent and in employment of 0.2 per cent. Nevertheless, the simulations also show that the reform has a negative impact on tax revenue. Assuming an elasticity of 1.1, tax losses amount to 2.4 billion Swiss francs in the short run and 1.1 billion Swiss francs in the long run.

In the third scenario (fifth and sixth column), these losses can ultimately be reduced via an increase in the tax on dividends. Given an elasticity of 1.1, the tax losses decline to 200 million Swiss francs in the long run. Although taxation of dividends leads to a slight reduction of the positive effects the reform has on GDP, investments and employment, it also prevents a short-term decline in private household consumption.

All in all, the simulations show that tax losses can be significantly limited or fully compensated by elements of CTR III while positive effects on the real economy are generated at the same time.

Mitigating the change in tax revenue

The study concentrates on those changes in policy that are explicitly part of the CTR III reform package. The tax deficits associated with the reform should lead to adjustments of income and expense instruments which will, for instance, vary among the different cantons. The study includes revenue losses caused by CTR III via lower transfer or higher tax payments by households. However, specific adjustments of expenditure (e.g. spending on education, infrastructure or culture) are not included in the model. Among other reasons, this approach was taken because the adjustments which become necessary due to the identified changes in tax revenue have not yet been specified and are hence not available for simulation analysis.

[1] Elasticity (εS) measures the sensitivity of the income of enterprises with special tax regimes to changes in the taxation differential between Switzerland and abroad. A high elasticity factor indicates higher sensitivity. In other words, high elasticity indicates that, given the same increase in the SPC tax burden in Switzerland relative to the foreign tax burden, the probability of a move abroad is higher.

The KOF Working Paper: « Introducing an IP License Box in Switzerland: Quantifying the Effects » Florian Chatagny, Marko Köthenbürger and Michael Stimmelmayr, No. 416 (2016) may be found here.

Contact

No database information available

Contact

No database information available

Contact

No database information available