Experts’ Expectations of Switzerland‘s Longer-Term Inflation Development

- KOF Consensus Forecast

- KOF Bulletin

KOF conducts quarterly surveys among economic experts from approximately 20 Swiss institutions to obtain their assessments of the country’s economic development. These assessments form the basis of the so-called KOF Consensus Forecast. Notable among them are the longer-term evaluations, for instance those on the subject of inflation.

In the context of the KOF Consensus Forecast, the KOF conducts quarterly surveys among economic experts at public and private institutions to obtain their forecasts of various economic and financial variables. The results of the KOF Consensus Forecast both present a picture of the experts’ expectations and allow for an assessment of the level of forecast uncertainty. Among other projections, the economists provide an inflation forecast for the current year and the subsequent year as well as their long-term expectations for a five-year horizon.

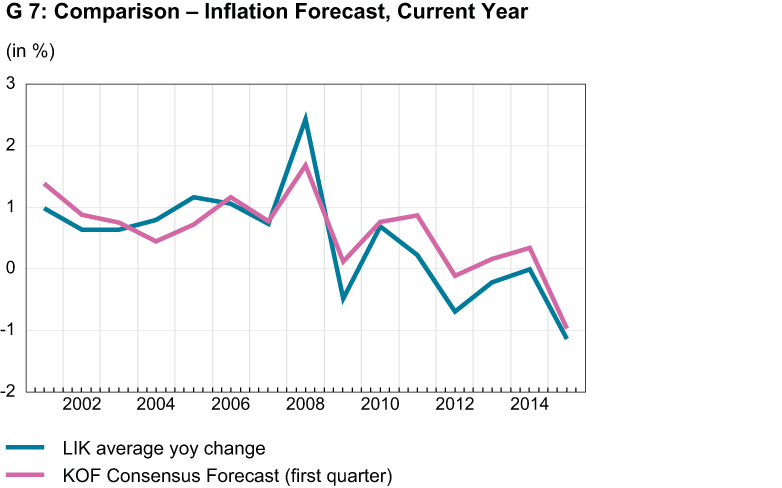

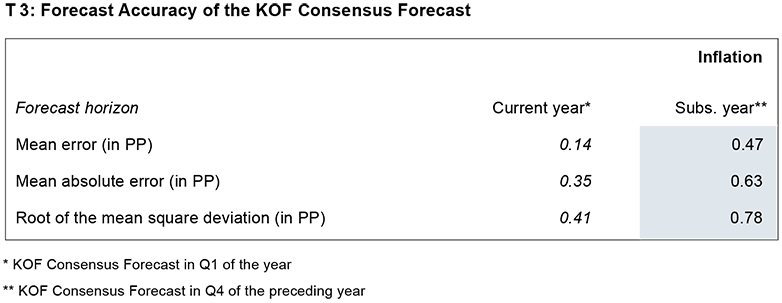

Compared to the real inflation rates, the forecasters have, on average, been overestimating the movement in prices since 2001. Graph G 7 shows the average year-on-year change in the national consumer price index (Landesindex der Konsumentenpreise, LIK) and the KOF Consensus Forecast for inflation in the current year (submitted in the first quarter of each year). The KOF Consensus Forecast has been higher than the real inflation rate, especially since 2009. Furthermore, various measurements of forecast accuracy (see T 3) emphasise the fact that inflation forecasts for both the current year and the subsequent year have been too high since 2001.

Consumer prices exposed to negative shocks

In the past few years, consumer prices in Switzerland were exposed to negative shocks. On the one hand, the oil price has dropped from 110 US dollar per barrel in 2014 to approximately 45 US dollar in 2016. On the other hand, the significant appreciation of the Swiss franc since 2008 has resulted in lower import prices which, in turn, are reflected in lower consumer prices. The substantial appreciation of the Swiss franc also has a dampening effect on domestic prices. In response to the appreciation, many companies have cut their margins to maintain competitiveness. Hence, in addition to the LIK recording negative rates of change of an average –0.5 per cent since 2012, this could be a partial explanation of the over-optimistic assessments delivered by the economic experts.

The Swiss National Bank (SNB) states price stability as its primary objective. For the Bank, price stability means a rise in consumer prices of less than 2 per cent a year. Deflation also violates the price stability objective. After the introduction of this concept at the end of 1999, the inflation rate was relatively stable at 1 per cent up until the financial crisis. A few factors indicate that market players had viewed this rate as the SNB’s tacit inflation target. However, in the period from 2000 to today, the average reported inflation rate has been as low as 0.5 per cent. With a view to the recent continuous decline in prices, it is of central importance to the SNB that long-term inflation expectations remain within its target range. If market players and consumers revise their inflation expectations downward or even expect a decline in prices, a deflationary spiral looms.

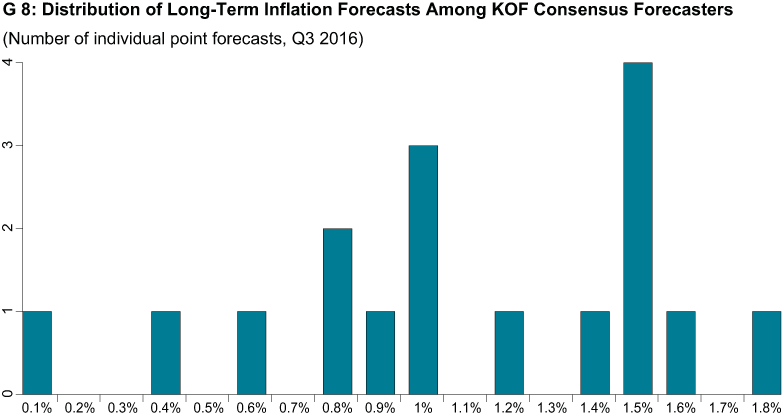

According to the KOF Consensus Forecast, the average long-term inflation expectations of the surveyed economists have amounted from 1 per cent to 1.1 per cent since the beginning of 2015. However, the forecasts vary considerably, currently ranging from 0.1 per cent to 1.8 per cent (see G 8). In the 3rd quarter 2016, seven of the 17 economists anticipated an inflation rate between 0.8 and 1.2 per cent in five years’ time. Seven respondents, however, expected long-term inflation between 1.4 and 1.8 per cent.

Assessment of probability

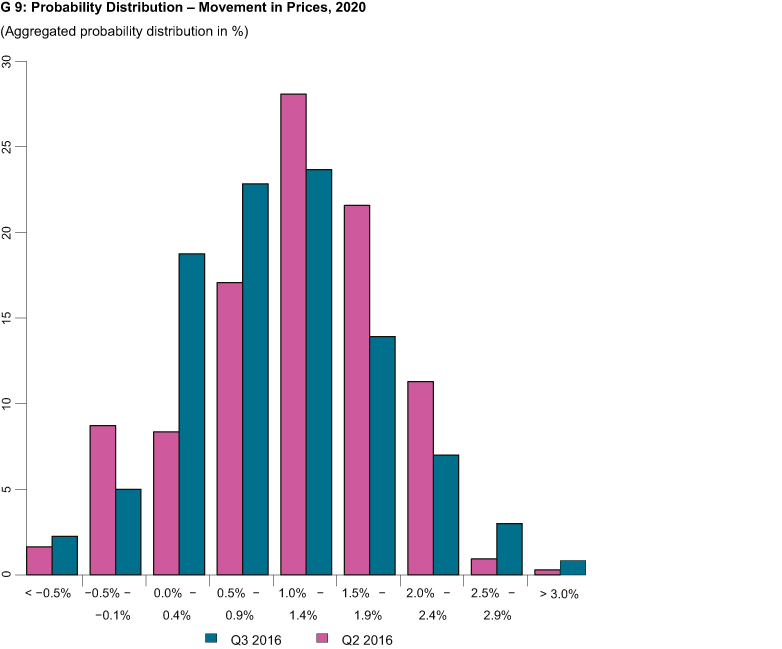

KOF also asks the economists to assess the probability of various inflation rates on a five-year horizon. This is summarised in an aggregated probability distribution which reflects the uncertainty associated with long-term inflation expectations (see G 9). In the third quarter 2016, the probability distribution of the movement in prices in 2020 has shifted to the left compared to the survey in the second quarter 2016. The proportion expecting an inflation rate under 1 per cent is 52 per cent. In the second quarter 2016, this figure was still 38 per cent. Furthermore, the mean of the aggregated probability distribution is 1 per cent, while both the meridian and the mode are higher. On top of this, the average point forecast is 1.1 per cent. One possible interpretation of these figures is a slight overweight of downward risks at the present time.

Hence, economic experts overestimate inflation rates in the short term. Despite the downward trend in prices in the last five years, long-term inflation expectations are still around 1 per cent. However, a recovery of consumer prices is crucial if price stability is to be ensured. Should the restrained price trend continue, long-term inflation expectations may be affected.

Further information regarding the KOF Consensus Forecast can be found here.

The next KOF Consensus Forecast will be published on 20 December 2016. It is not the KOF Economic Forecast, which will be published on 15 December 2016.

Contact

No database information available