KOF Economic Forecast, Autumn 2017: International Momentum Stimulates Swiss Economy

- Swiss Economy

- KOF Bulletin

According to the latest KOF Economic Forecast, the next two years look good for the Swiss economy. Aside from positive international trends, this is also due to special factors, such as licence revenues from sport events. The labour market is recovering with a slight time lag and prices are slowly picking up again.

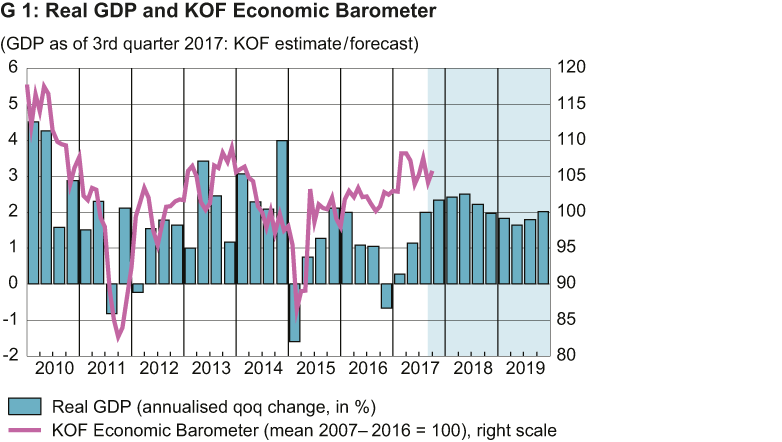

Both leading and coincident indicators are painting an optimistic picture of the current economic situation in Switzerland (see G 1). On top of this, the Swiss Federal Statistical Office (FSO) has revised the national account data, resulting in a higher Swiss production level and higher production growth rates in the past few years. Even 2015, the year that started with the suspension of the minimum exchange rate, has ended up with a revised growth rate of 1.2 per cent 1 .

GDP figures for the past winter half-year come as a surprise

The quarterly figures published by the Swiss State Secretariat for Economic Affairs (SECO) thus came as a big surprise. According to SECO’s estimates, Switzerland’s economic output at the end of 2016 had declined for the first time since the first quarter 2015, and both the third quarter 2016 and the first quarter 2017 were also disappointing. The statistical benchmarks, and due to technical reasons (statistical overhang) also the prospects for the full year 2017, are thus much gloomier than they were during the last forecast in June. Although KOF anticipates a significant improvement in the second half of the year, the weak winter figures are pushing down the annual growth rate to 0.8 per cent - a substantially lower figure than predicted in June (1.3%) (see G 1).

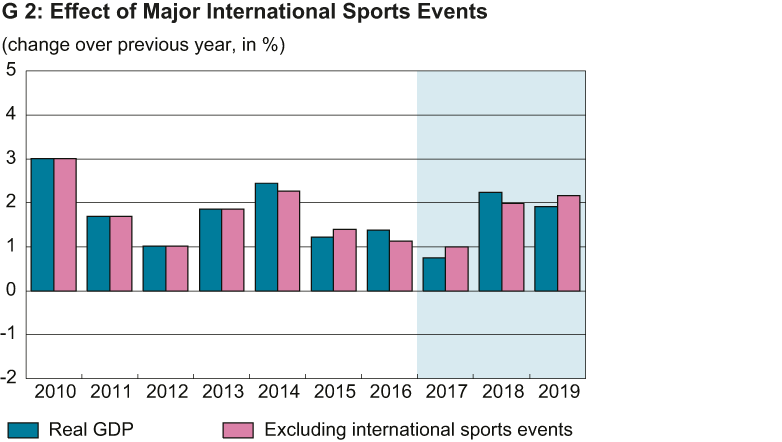

Around half of the revisions are due to the inclusion of economic activities that had not been fully recorded in the past. These activities consist of the sale of brand and broadcasting rights associated with major international sports events. Although such events take place regularly, they do not occur on an annual basis. In addition, the respective economic activities are recorded at the location of the venue, and venues change all the time. However, licence revenues are collected by the respective sport associations, a number of which are domiciled in Switzerland. In 2016, the Olympic Summer Games took place in Brazil and the European Football Championship was held in France. Both the International Olympic Committee (IOC) and the European Football Association (UEFA) are based in Switzerland, and the income generated from these events, especially from the TV broadcasting rights, are substantial. The revenues from the TV rights to the Olympic Games alone amounted to just under three billions Swiss crancs . A portion of the revenue is spent on activities connected with the organisation of the games and are thus recorded as input. Nevertheless, sports events raised Switzerland’s value creation by close to two billion Swiss francs in 2016. The impact on the price-adjusted growth rate is thus 0.2 to 0.3 percentage points (see G 2).

Popular sports events impact Swiss GDP every two years

The coming year will see two further important sports events managed by Swiss-based organisations: the Olympic Winter Games will be held in South Korea at the beginning of the year and the Football World Cup will take place in Russia in summer. Thanks to this special effect, the 2.2 per cent growth rate expected by KOF exceeds the country’s actual economic activities. Since these sports events always take place in even years, the new statistical method of recording such revenues in the country’s GDP will result in fluctuations in economic growth every two years.

However, this inconsistent value creation does not have any noticeable effect on the Swiss labour market since the significant revenue fluctuations do not result in major changes in employment. KOF therefore anticipates no more than a minor drop in the unemployment rate (0.1 percentage points) in the coming year. The expected registered unemployed rate will thus be 3.1 per cent, while the quota according to the internationally comparable ILO (International Labour Organisation) standard (referred to as ‘unemployment rate’ in Switzerland) will be 4.7 per cent. The employment trend, which has been affected by growing rationalisation pressure since 2015, looks set to return to a more positive development. This trend is also supported by the weaker Swiss franc.

Monetary policy will remain expansive, irrespective of the easing of tension on the foreign exchange market. Although long-term interest rates will rise slowly from next year onwards, short-term interest rates are not likely to go up before the European Central Bank (ECB) has raised the respective Eurozone interest rate – a move that is only expected to happen in the subsequent year. However, if the Swiss franc should remain on the weak side, we can expect a gradual reduction of foreign exchange reserves. This would require growing numbers of domestic investors turning their attention to foreign investments.

Swiss exporters will benefit from the robust economic development in Europe and the USA. In the last few years, their sales expansion opportunities were reduced by the strong Swiss franc and the slow global economy. Following the franc’s depreciation and the upswing of the global economy, prospects for higher sales volumes and prices have improved, and both industry and tourism are expected to follow a positive trend. The situation in the financial sector has also improved, although a return to previous revenues and margins is unlikely, due to increasing international cooperation in tax matters and tighter regulations.

In the past few years, the domestic economy helped mitigate the economic impact of negative impulses from abroad. Largely balanced budgets and a growing population resulted in investments in both infrastructure and the healthcare and education sectors. Housing construction, an area in which net value creation has grown by around 60 per cent in the last 15 years, has also expanded. However, given the current high level of activities in this area, a further increase is not expected in the next few years.

Lower VAT rate as of 1 January 2018

After the rejection of the AHV-plus model involving additional financing via VAT on 24 September 2017, the value-added tax rate will be reduced by 0.3 percentage points as of the year 2018. However, this cut will affect only a small portion of consumption, and imported products are expected to become more expensive rather than cheaper due to the weak Swiss franc. All in all, inflation is therefore unlikely to change substantially, and KOF does not anticipate a return to falling consumer prices.

Lower margins in many sectors have resulted in weak wage trends in the last few years. Improved economic prospects will lead to stronger wage dynamics, albeit not in the short term. Higher wage agreements are not likely to be concluded before companies have managed to increase their margins.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland