Interpretation of Foreign Trade Data Will Become More Difficult

- Business Cycle

- KOF Bulletin

In 2019 and 2020, Swiss pharmaceutical exports are likely to grow slower than experts would have expected under previous conditions. This is due to a new trading model: Goods that are bought abroad and subsequently sold abroad will no longer be transported via Switzerland. As of 2020, the level of pharmaceutical exports will be around 6% lower than they would have been under the previous export model.

Two contributory factors shape the analysis of Switzerland's economic activity and market forecasts: the economic development of Switzerland's key trading partners and the foreign trade statistics. However, analysis of the foreign trade data will become more difficult in the future. This is due to a new trading model in the pharmaceutical sector.

At present, this concerns a section of the pharma industry that buys goods from abroad and subsequently sells them abroad. While the producers and buyers remain the same, the products will no longer be transported via Switzerland but will be delivered directly by the foreign producer to the foreign buyer. Nevertheless, the owner of the goods changes as before, which means that the goods are bought by the Swiss-based company and subsequently resold abroad.

The process is thus very similar to traditional merchanting. However, the key difference is that these are not freely tradable goods but goods which are linked to their delivery via production orders. Since the producer, the distributor and the buyer are all part of the same group of companies, these are intra-group transactions. Such transactions are not comparable to the transactions of an independent commodity dealer who finds buyers and sellers for freely tradable goods.

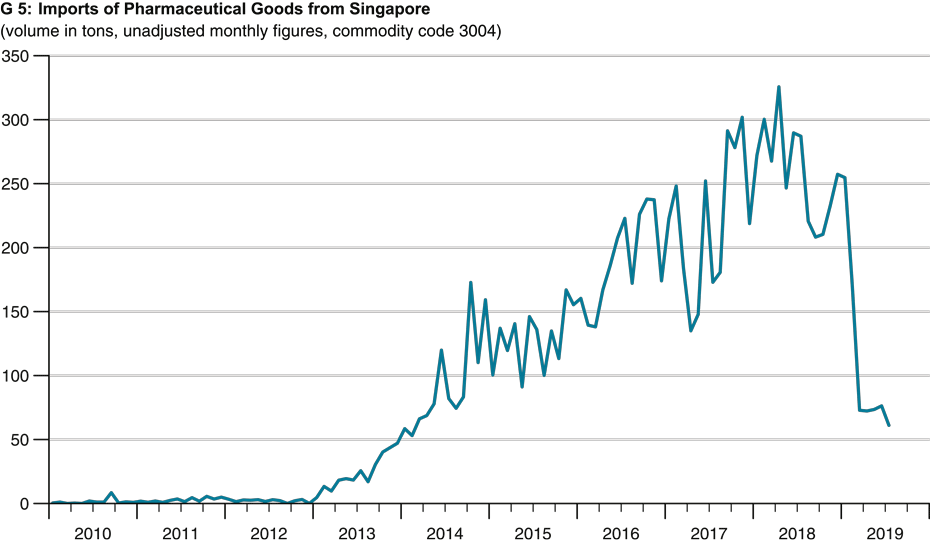

Imports and exports of pharmaceutical products set to decline

According to the guidelines pertaining to the current account statistics, the above intra-group transactions must generally be posted as merchanting. The exception are goods that are processed in a third country while remaining the property of the Swiss company. In this case, the purchases and sales must be posted as normal goods transactions.

Under the merchanting system, sales are posted as exports, while purchases are classified as negative exports. Hence, exports and imports of pharmaceutical products will decline under the new trading model. On top of this, as far as the aggregated foreign trade figures (including merchanting) are concerned, both imports and exports will decline in the amount of the import values of the respective pharmaceutical products.

All in all, as of 2020, pharmaceutical exports will be around 6% lower than they would have been under the previous trading model. In terms of volume, the decline is the same on both sides. However, the value amounts on the export side will be disproportionally higher due to the trade margin. In traditional merchanting, this margin amounts to just under 5%. In the pharma industry, the margin is likely to be significantly higher since, up until now, it had served to finance centralised group tasks (for instance R&D expenditure) and to skim excess profit from foreign subsidiaries.

Problems with the calculation of inventory changes

In the national accounts, both the exports and imports and the current account will be affected on the expenditure side. The calculation of inventory changes will be associated with further problems if the purchase and the sale of the goods is not simultaneous. On the production side, the added value remains unchanged.

Should pharmaceutical companies perform these transactions via a new trading company in the future, added value will shift from the pharma industry to the wholesale sector, which is part of the service industry. Inferences regarding added value in the previous merchanting system will become more difficult, or even impossible.

Cost and climate benefits

The gradual introduction of the new trading model started at the beginning of the year. The biggest change has occurred in the import volumes of pharmaceutical products from Singapore. As a consequence of the changes, foreign trade in goods as registered by the Swiss Federal Customs Administration will be weaker than before. However, the changes caused by the new trading model must not be interpreted as a negative economic signal or as a consequence of excessive protectionism.

Nevertheless, the conversion results in lower demand for transport services, which is both a cost and a climate benefit. It is not entirely unlikely that the conversion will be imitated in other sectors where certain goods are also physically transported through Switzerland and delivered to end customers abroad.

More details about this topic (in German) DownloadKOF Analysen Autumn 2019vertical_align_bottom.

Contact

KOF FB Konjunktur

Leonhardstrasse 21

8092

Zürich

Switzerland