Companies looking to stockpile preliminary products

- Globalisation

- Business Cycle

- KOF Bulletin

Intermediate products such as semiconductors and some raw materials are currently highly in demand among firms. Strong consumer demand for end-products and the resulting high levels of output, as well as friction in the supply and transportation of intermediate products, are causing the latter to become scarce and more expensive. In addition, however, companies’ strong orders of intermediate products could exacerbate this shortage. There are certain indications of this in Switzerland.

The shortage of intermediate products and the rising prices of intermediate inputs are currently topics of intense international debate. In its World Economic Outlook in October 2021, for example, the International Monetary Fund (IMF) described supply problems as a challenge that is acting as a drag on 1) the short-term economic recovery, primarily in the highly developed economies. There are many reasons for this challenging supply situation. The pandemic sometimes causes production stoppages owing to closures or low staffing levels. In addition, there are difficulties in logistics, for example when goods clearance at seaports is restricted. But there have also been other problems on the production and transport side. For example, a cold snap at the beginning of 2021 forced chip manufacturers in Texas to cut production, while water shortages caused similar problems for other manufacturers in Taiwan. The container ship Ever Given blocked the Suez Canal for six days, creating a huge traffic jam of cargo ships.

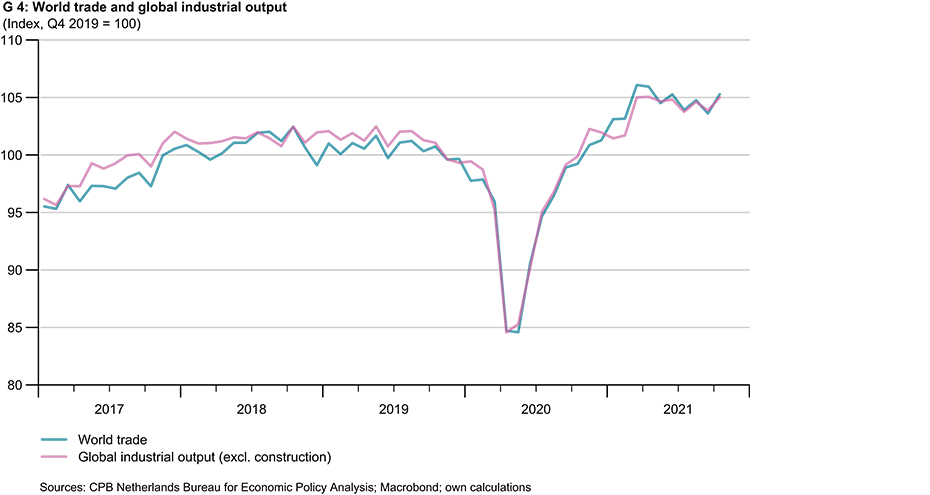

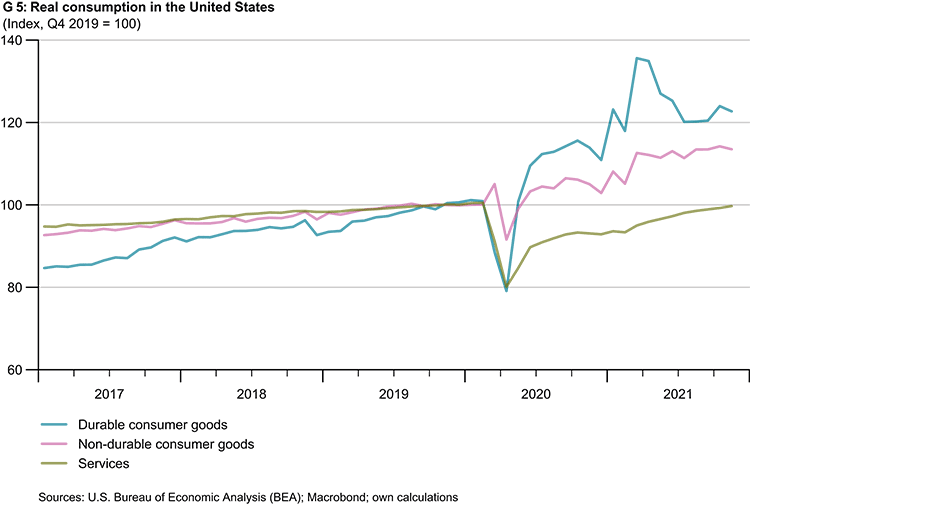

However, these disruptions should not obscure the fact that global output and international trade in goods are operating at full capacity. Both have recovered rapidly since the slump in spring 2020 (chart 1). Their pre-crisis levels were easily exceeded at the beginning of 2021. International trade is therefore by no means in a slump – on the contrary. One major reason for the shortage of intermediate products is the extremely strong demand for end-products. This high demand stems partly from the fact that consumers are increasingly buying goods rather than services during this pandemic. Chart 2 uses the example of consumers in the United States to illustrate this. Extremely strong demand is pushing supply chains – which are currently highly susceptible to disruption – to their limits. A normalisation of consumption patterns coupled with fewer pandemic-related disruptions in production and logistics could ease the shortage of primary products over the course of this year.

Nevertheless, the question arises as to whether companies will alter their purchasing policies and stockpiling of intermediate products in view of the current availability issues? A survey conducted by the German Chamber of Industry and Commerce (DIHK) among its member firms in the summer of 2021 suggests 2) that they will. This survey carried out in Germany reveals that more than half (57 per cent) of companies across all sectors intend to increase their stockpiling in order to secure their own production capacity. Overall, however, such a strategy may exacerbate the existing problems with primary products by further increasing demand. This might constitute a general long-term strategy, such as permanently higher stockpiling and a partial abandonment of just-in-time production. However, it could be a merely short-term effect – such as a ‘bullwhip effect’ involving greater order fluctuations – if companies order too much now and then have to reduce their inventories later because they believe they have too many intermediate products in stock. 3)

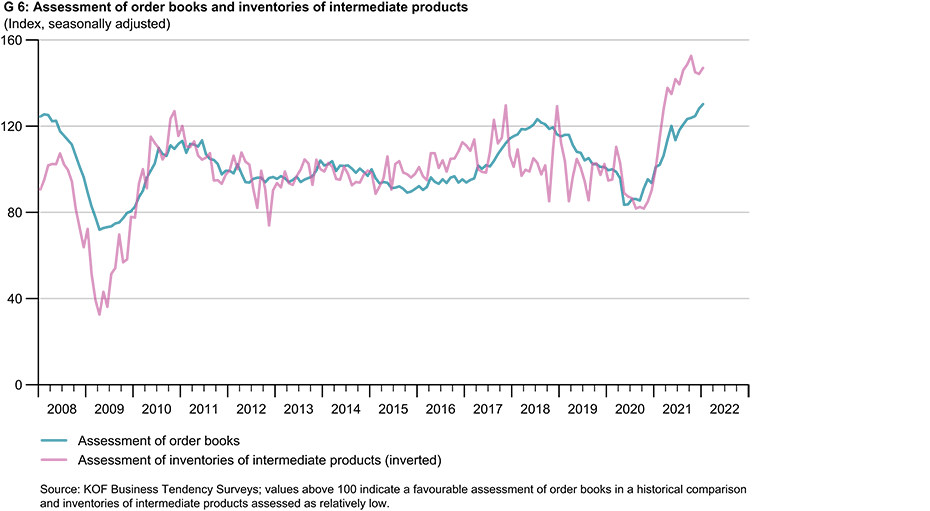

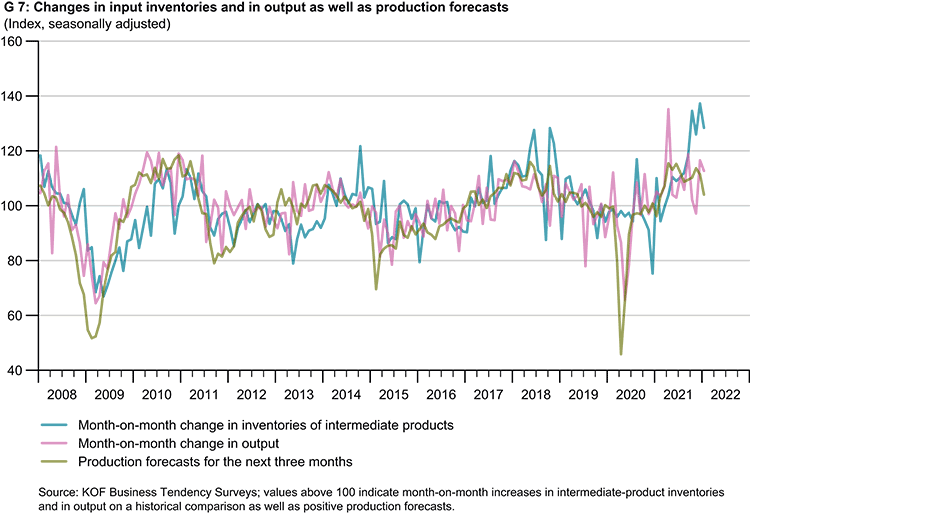

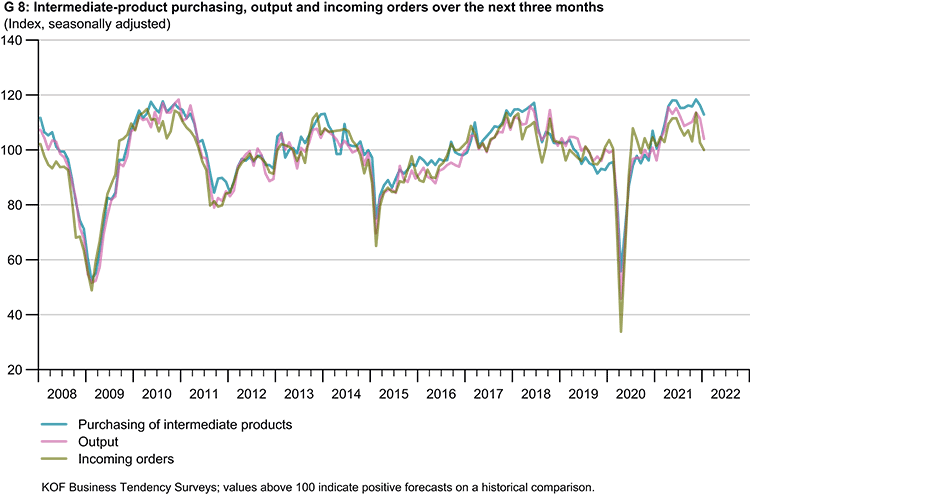

How are Swiss companies reacting? Are they stockpiling preliminary products? You can look for clues in the results of the KOF Business Tendency Surveys of the manufacturing sector. Chart 3 shows that firms’ order books are currently fairly full. 4) More than ever before, however, they reckon that their inventories of intermediate products are too low. They consider their inventories to be quite small despite the fact that they have increased them frequently over the past few months (chart 4). Although output has also performed well and production plans are expansionary, the figures here are not rising quite as sharply overall as those for intermediate product inventories. A similar phenomenon is observed when comparing planned input purchases with production plans and expected order intake (chart 5). All three plans or expectations can be classified as above aver-age when compared over the medium term – at least until the end of 2021. However, planning for the purchase of primary products stands out slightly at the top.

Last autumn’s survey results indicate that manufacturing companies tend to purchase input products in large quantities, or at least try to do so. However, purchasing behaviour has not completely decoupled from output performance and expected demand. Strong demand is likely to be the main reason for these firms’ expansionary purchasing policies, even though they are probably ordering fairly large quantities of intermediate products in addition. This could be due to a fundamental change in inventory strategy or, alternatively, because companies see demand for their products being curbed by the challenging situation around intermediate products, which could subsequently ease. This could be a possibility, for example, for companies that are stuck within supply chains rather than being at their end. On the other hand, firms could aim for even larger inventories of inputs but this inventory strategy might be thwarted by shortages. Whatever companies’ intentions may be, there are tentative signs that they are tending to order inputs in large quantities. If this practice were to become widespread – especially internationally – then this corporate behaviour would exacerbate the excess demand already being generated by consumers.

------------------------------------------------------

1 International Monetary Fund, ‘World Economic Outlook, Recovery During a Pandemic – Health Concerns, Supply Disruptions, and Price Pressures’, October 2021. Link: [external pagehttps://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021call_made]; accessed on 23 December 2021.

2 See [external pagehttps://www.dihk.de/de/themen-und-positionen/wirtschaftspolitik/konjunktur-und-wachstum/blitzumfrage-lieferengpaessecall_made]; accessed on 23 December 2021.

3 See, for example, Hyun Song Shin, Bank for International Settlements, 2021, for a current discussion from an economic perspective: external pagehttps://www.bis.org/speeches/sp211209.pdfcall_made

4 Indexation is carried out for all charts on the results of the KOF Business Tendency Surveys by means of a robust standardisation of the form (x - median(x))/MAD(x)*10+100. This standardisation is intended to make the time series more comparable. The median and MAD are used to mitigate the impact of very large fluctuations. However, the results also tend to show up with ordinary standardisation with the arithmetic mean and empirical standard deviation.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland