KOF Business Tendency Surveys: Swiss economy on course for recovery despite omicron wave

- Swiss Economy

- KOF Bulletin

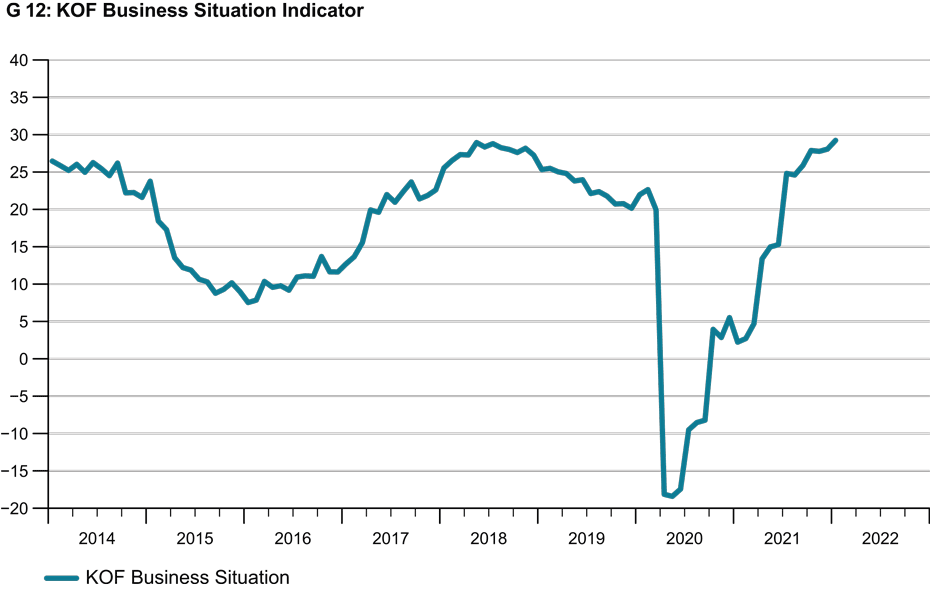

The KOF Business Situation Indicator rose slightly again in January. The Swiss economy’s recovery is thus continuing at the beginning of the new year. The outlook for business in the near future remains predominantly positive. However, it has been dampened and is no longer as encouraging as it was at the end of last year.

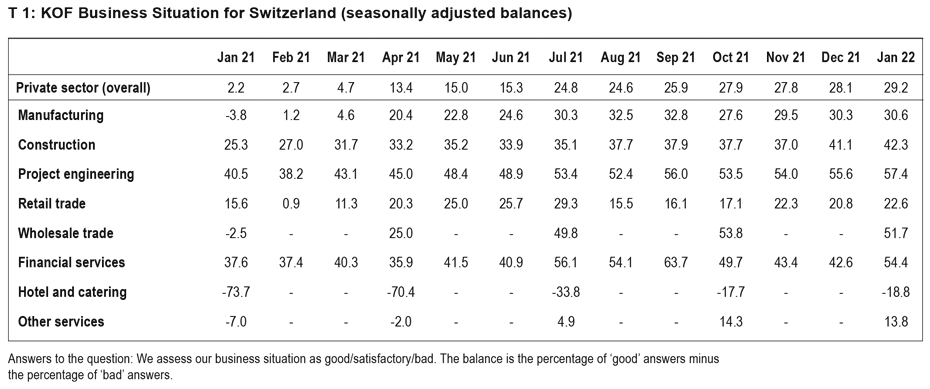

The coronavirus-induced gap between the sectors surveyed is widening slightly again. Where business activity was already above average in certain sectors it is tending to improve further. This is the case in manufacturing, the retail sector, construction and project engineering and, especially, among financial and insurance service providers. In contrast, the recovery is faltering in sectors where business activity was already below average, such as in other services and the hospitality industry. There is also a tendency throughout January for hospitality businesses that responded later in the month to assess their situation less favourably than businesses that provided their information earlier. In the other sectors, however, such a pattern is not quite so evident (T 1).

Omicron wave causing staff shortages

Complaints about a shortage of skilled workers increased in many sectors as early as the second half of 2021. Now the loss of employees due to the omicron wave is exacerbating the already challenging staffing situation. However, firms can usually compensate for absences of small numbers of workers. Among the companies that responded to a specially included question, the loss of turnover is about 1 per cent when up to about 15 per cent of their workforce is quarantining or self-isolating. If more employees are absent, however, the decline in turnover increases significantly. Businesses in the hospitality industry, which have already been hit hard by the pandemic, are likely to suffer particularly from staff shortages, although hospitality businesses as a whole complain much more frequently about a lack of guests than about workers who cannot be deployed.

Primary products remain in short supply

In the goods-producing and goods-distributing sectors – manufacturing, construction, retailing and wholesaling – the availability of intermediate products continues to be a significant problem, even tending to be more important than the problem of staff shortages. At least these difficulties have not increased further in the construction industry and the retail sector compared with the autumn. In manufacturing and wholesaling, on the other hand, they have, although there are signs of stabilisation at a high level around the turn of the year. More than half of the companies responding in the manufacturing and wholesale sectors are currently reporting disruption owing to insufficient supplies of intermediate products.

Prices are rising in almost all sectors

In January, prices continued to increase in many sectors of the economy. Price pressures are again particularly pronounced in the goods-producing and goods-distributing sectors such as manufacturing, construction, retailing and wholesaling. But the trend towards price rises was increasing in other services as well at the beginning of the year.

Recovery in the manufacturing sector continues tentatively

In the new year the manufacturing sector is continuing the positive trend seen at the end of 2021. Business is improving for the third month in a row, albeit only very slightly. Despite the current omicron wave, uncertainty about future business activity has not increased. Although satisfaction with existing order books is growing, production plans are significantly less expansionary than they were in December.

The situation in the construction segments is encouraging

In January, business continued to improve in the project engineering and construction sectors linked to building activity. Demand in the construction industry is performing well and order books are currently fairly full. Firms in the finishing trade in particular are reporting ample orders on hand. Order books in the main construction trade, on the other hand, are only rated as satisfactory. Overall, technical capacities in the construction industry continue to be utilised at above-average levels. Construction activity is expected to continue to grow in the near future and prices are forecast to rise sharply.

Business trends in the retail sector are encouraging

The business situation in the retail sector improved in January. It is currently better than it was at the beginning of last year but not as buoyant as it was in the summer. After dipping at the beginning of the autumn, sales are now increasing and earnings are coming under less pressure. The business situation in the wholesale sector at the beginning of the year was slightly gloomier than it had been in the autumn. However, there are highly divergent trends in the individual segments. Business activity in the wholesale trade in goods used for production continues to improve. In contrast, business in the wholesale trade in consumer goods is slowing considerably.

The hospitality industry is holding its breath at the beginning of the year

The hospitality sector has started the new year fairly well in both the alpine and lake regions. On the other hand, businesses in the major towns and cities have suffered a setback. The overall business situation has hardly changed since the autumn, and the recovery in the summer and autumn has not continued for the time being. There is also a tendency for responses submitted later in January to be less favourable than the earlier ones. This is likely to be related to the rapid spread of the omicron variant. Uncertainty about business going forward remains high and increased further in January.

Financial and insurance service providers are more satisfied with their current business

Business in financial and insurance services is recovering strongly after going through a weak phase in the autumn. Although earnings are no longer performing quite as well as in previous months, expectations about the future performance of earnings remain almost unchanged and confident. However, uncertainty about business going forward is increasing.

Business activity among other service providers is slowing

The remaining service providers are more or less flatlining. Their business situation is slightly less encouraging than it was in the autumn of last year. The improving trend noticeable throughout the past year is thus coming to an end for the time being. Business in personal services – for example in the sub-sector of arts, entertainment and recreation – visibly deteriorated at the beginning of the year. Capacity utilisation in January no longer increased overall and declined slightly in business services and personal services. The transport sector, on the other hand, is gaining momentum. All in all, capacity utilisation throughout the rest of the service sector remains below pre-crisis levels.

The results of the latest KOF Business Tendency Surveys for January 2022 include the responses of around 4,500 firms from industry, construction and the major service sectors. This equates to a response rate of about 58 per cent. You can find out more about the Business Tendency Surveys here.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland