Industrial companies investing to increase capacity

KOF Bulletin

The investment outlook for Swiss companies this year is encouraging. According to the findings of the semi-annual KOF Investment Survey, firms intend to increase their fixed investment by a nominal 3.4 per cent in 2022. In the manufacturing sector in particular, this investment will help to expand their technical production capacity.

Swiss companies are again planning to invest more this year than they did last year. This is shown by the findings of the latest KOF Investment Survey from autumn 2021, according to which survey respondents expect to see growth in fixed capital formation of 3.4 per cent in nominal terms for 2022. Compared with previous surveys, these are rather tentative investment plans, which are primarily driven by the investment outlook in the manufacturing sector, where investment is expected to increase by around 6 per cent. Companies from the food, beverage and tobacco industry (up 19 per cent) as well as mechanical and automotive engineering (up 11 per cent) expect to see a surge in capital spending. In contrast, the investment growth expected in the service sector is moderate at around 2 per cent, while firms in the construction industry are actually planning to reduce their investment by around 6 per cent.

This planned capital expenditure will increasingly be allocated to new buildings as well as conversions of business premises and commercial property. 30.6 per cent of respondents intend to expand their construction investment this year (compared with 27.6 per cent last year, according to the previous survey in autumn 2020). The proportion of companies planning to invest in equipment and machinery this year has also increased on balance. Overall, however, fewer firms plan to invest in research and development.

Demand and earnings driving expansion investment

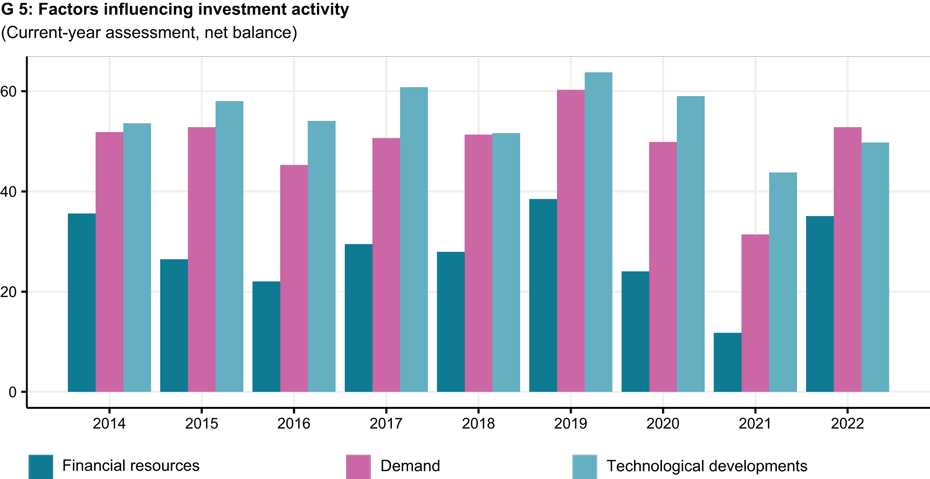

The survey’s findings show that both the expected level of demand and the financial resources available are stimulating the investment outlook for this year (see chart G 5). Compared with last year, the importance of demand as an influencing factor has increased on balance from 31.4 points to 52.8 points. Similar to this rise is the growing importance of earnings as a factor positively impacting Swiss companies’ future investment activity. This stimulus can be seen across all sectors but is most pronounced in manufacturing.

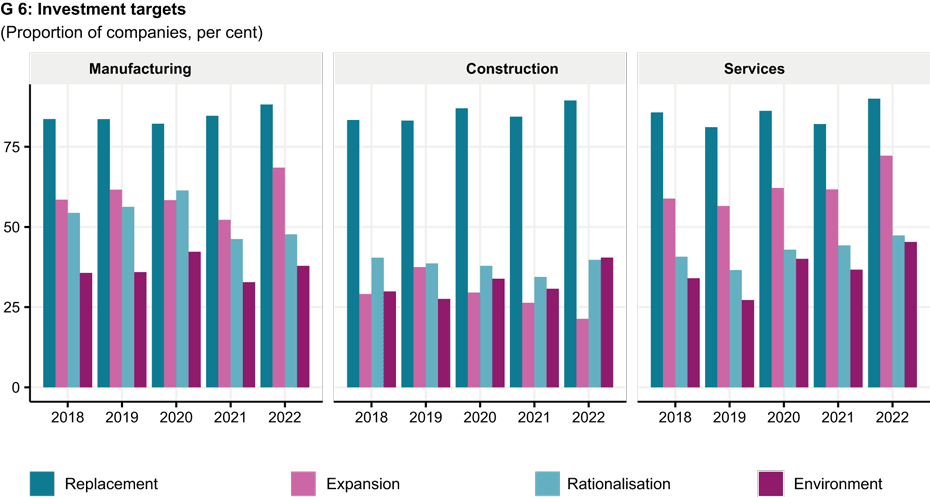

This positive demand stimulus is also reflected in investment targets. Although capital spending at most companies is still being used to replace existing fixed assets, investment in the expansion of production and service provision has gained significantly in importance. In manufacturing, around 69 per cent of the companies surveyed say they are planning to expand during the current year (see chart G 6). In the last survey conducted in autumn 2020, this figure was significantly lower at 52 per cent of industrial companies. In the services sector, too, the proportion of firms planning to invest in expansion has risen from 62 per cent last year to 72 per cent in 2022. Expansion investment increases the capital stock and, consequently, production capacity as well, which is why it can be interpreted as an indicator of companies’ growth expectations. Firms invest in the expansion of their facilities primarily when they expect demand to increase. The larger proportion of companies that plan to invest in expansion suggests strong demand stimulus, especially in industry.

Companies in the manufacturing sector intend to considerably expand their production capacity

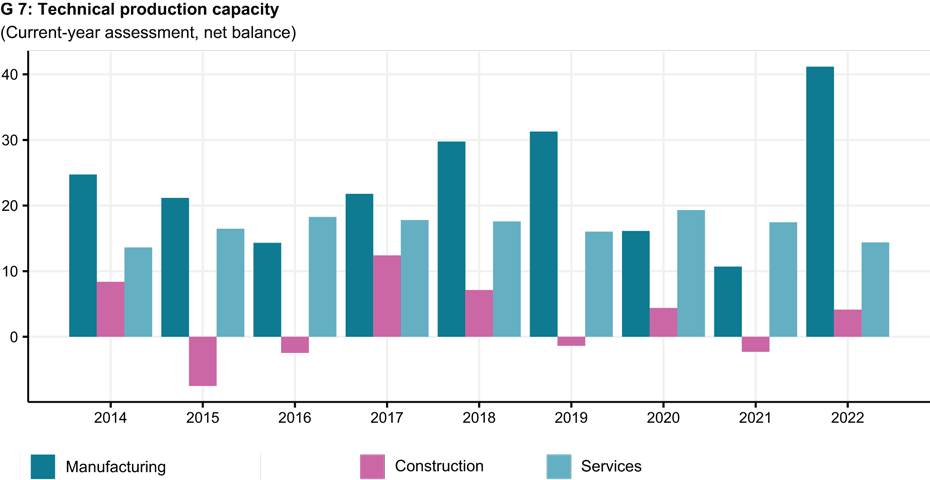

Companies in the construction sector plan to slightly increase their production capacity further in 2022, with around 10 per cent of survey respondents intending to expand their capacity and only 6 per cent looking to reduce it. On balance, the relevant indicator thus rises from -2.3 points to 4.1 points (see chart G 7). This increase is even more pronounced in manufacturing. Some 44 per cent of industrial companies plan to expand their capacity this year. By comparison, only 21 per cent of these firms had intended to do so in 2021. Conversely, only 3 per cent plan to reduce their capacity this year. This figure was 10 per cent in the last survey in autumn 2020. This means that the indicator for the manufacturing sector has risen from 10.7 points to 41.2 points. According to the survey’s findings, around 35 per cent of companies in the manufacturing sector intend to use their additional capacity to manufacture new products or add them to their product ranges.

Economic growth is strongly influenced by companies’ investment activity. The KOF Swiss Economic Institute at ETH Zurich therefore conducts a survey of domestic firms every spring and autumn. The semi-annual survey for autumn 2021 was carried out from 27 September to 31 December 2021. 6,154 companies were contacted as part of this survey and 2,707 responded, which corresponds to a response rate of 44 per cent.

Contact

KOF FB Konjunkturumfragen

Leonhardstrasse 21

8092

Zürich

Switzerland