Robust Upswing in the USA

- KOF Bulletin

- World Economy

On 8 November 2016 a new President will be elected in the USA. Throughout the protracted and often controversial election campaign, questions of economic policy have only occasionally been at the forefront – in spite of the strongly divergent standpoints of the candidates. At present, opinion polls suggest that Hillary Clinton will be elected, which would result in a continuation of current economic policy. Although the election result is uncertain, the economic implications are expected to be minor.

Uncertainty regarding future economic development has a negative effect on investment and consumer spending. Continuity within economic policy thus provides a major contribution to a robust economic growth dynamic. Uncertainty regarding the election results is significant, in particular given the strong political differences between the candidates. For example, the current election campaign has been marked by strong differences of opinion regarding the future direction of fiscal policy as well as social and labour market policy. On the other hand, there is greater overlap between their views on foreign policy, at least regarding the somewhat critical stance towards new free trade agreements.

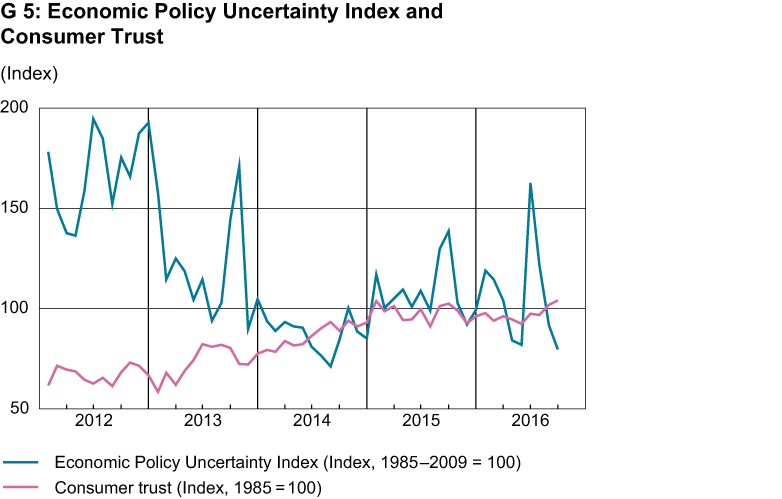

Most opinion polls and market expectations currently suggest that Hillary Clinton will be elected and that current economic policy will generally continue. Indeed, the implementation of questionable home affairs election promises would in most cases meet with resistance in Congress. This starting point focused on continuity is also apparent within uncertainty and confidence indicators. The Economic Policy Uncertainty Index (see also the contribution on “Measuring Uncertainty”), which measures the frequency of the recurrence within newspapers of terms associated with economic uncertainty, is currently at a comparably low level (see graph X). The purchasing managers’ index of the Institute for Supply Management, a reliable early indicator for the US economy, is also expanding, unconcerned by the political uncertainty. Consumer confidence as surveyed by the Conference Board currently suggests good consumer sentiment, whilst on the other hand the sub-indicator focusing on the future points to somewhat more muted expectations.

Steady economic development

Uncertainty regarding the election result rose somewhat over the summer months, as Donald Trump was consistently able to chip away at his opponent’s lead in opinion polls. However, the economic certainty this created had barely any effect on the economy. The robust recovery in the US economy is continuing. According to initial estimates by the Bureau of Economic Analysis, overall economic production in quarter 3 of 2016 grew by an annualised rate of 2.9 per cent compared to the previous quarter. The unemployment rate is at present 5 per cent, thus close to full employment. In addition, the share of people in work or looking for work has stabilised at around 63 per cent of the working-age population, which is regarded as a positive sign by the US central bank, the Federal Reserve (Fed), taking account of demographic changes.

The dynamic labour market is gradually slowing salary growth, which is soon expected to put prices under pressure. The diminishing base effects of earlier falls in commodity prices are already leading to increases in inflation. Thus, the year-on-year change in the consumer price index most recently lay at 1.5 per cent whilst the core inflation rate in September, without energy and unprocessed foods, amounted to 2.2 per cent. The creeping inflation and the good employment outlook are expected to confirm the Fed’s view that the target range for the Federal Funds Rate should be increased to between 0.5 and 0.75 per cent by the end of the year.

Close trading links between Switzerland and the USA

Since the United States represents an important sales market for Swiss exporters, stable expansion is also of major significance for Switzerland. Thanks to the comparatively robust economic development in the USA, demand for Swiss goods since the financial crisis has doubled in nominal terms. According to the Direction of Trade Statistics of the International Monetary Fund for 2015, Swiss companies shipped goods across the Atlantic worth more than 30 billion US dollars, accounting for around 9 per cent of total exports. Thus, after Germany, the USA is the second most important sales market for exported goods. In addition, around 45 per cent of the Swiss balance of trade for goods is earned with the USA.

Over the last few years, chemical products, including in particular drugs and other pharmaceutical products, have accounted for almost one half of goods exported to the USA. The widely diversified machinery exports make up a proportionally shrinking share, which however with more than 10 per cent remains very important. Other important export goods include watches and clocks and medicinal instruments, with around 10 per cent each.

Conversely, in 2015 the United States exported goods worth more than 22 billion US dollars to Switzerland, which corresponds to a share of only 1 to 2 percent of total US exports. Almost one half of imports from the USA are precious metals, including in particular non-monetary gold which is imported to Switzerland for refinement. Around 20 per cent is comprised of chemical products, including above all pharmaceuticals. On the other hand, machinery and transport make up only around 10 per cent of imports to Switzerland.

The services sector of the USA is in fact Switzerland’s most important trade partner: 16 per cent of exported services and more than 20 per cent of imported services result from trade relations with the USA. One third of this amount is comprised of licence fees, although the total also includes business services and ICT services, which play an important role within the trade in services between Switzerland and the United States. In addition, Americans account for around 9 per cent of foreign overnight stays, which also makes the USA an important sales market for tourism services.

Contact

KOF Konjunkturforschungsstelle

Leonhardstrasse 21

8092

Zürich

Switzerland