International Stock Return Predictability: On the Role of the United States in Bad and Good Times

- KOF Bulletin

- World Economy

Are stock market excess returns in ten industrialised countries only predictable by means of lagged U.S. stock returns? “It depends” would be the right answer. The claim stands the test in recession but not in normal times, as shown in a new KOF Working Paper.

There is a strong debate in empirical finance literature on whether stock market excess returns are predictable. For example, Welch and Goyal (2008, p. 1504), upon conducting a very comprehensive exercise testing of the most popular variables, which were considered to be good predictors of the excess stock returns in previous literature, conclude that “... most models seem unstable or even spurious”. Nevertheless, in a recent contribution to the discussion, Rapach et al. (2013) argue that lagged US stock market returns demonstrate a superior out-of-sample predictive ability of excess returns in stock markets of 10 industrialised countries (Australia, Canada, France, Germany, Italy, Japan, the Netherlands, Sweden, Switzerland, the United Kingdom) relative to a popular benchmark represented by the historical average.

The KOF working paper scrutinises the results of Rapach et al. (2013) in order to verify whether the documented superior forecasting performance of lagged US stock market returns is indeed stable during recession and expansion phases of the business cycle in the US. To this end, it first replicates the results reported in Rapach et al. (2013) for the whole forecast evaluation sample that spans the period January from 1985 to December 2010 and then evaluates the forecasting performance of lagged US returns separately for business cycle expansions and recessions, using the business cycle chronology of the National Bureau of Economic Research (NBER). During the period in question, there were three recession periods characterised by the business cycle peaks in July 1990, March 2001 and December 2007 and the corresponding troughs in March 1991, November 2001 and June 2009.

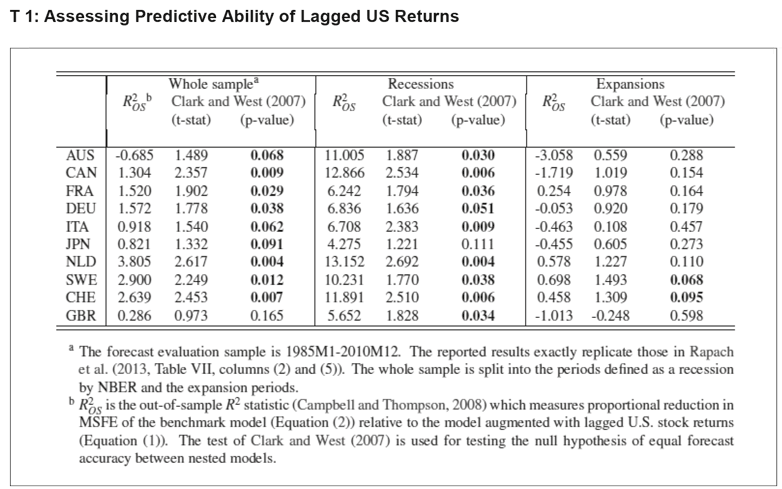

The empirical results are summarised in Table T 1. It reports the values of out-of-sample measure of the goodness of fit R2OS suggested in Campbell and Thompson (2008), as well as t-statistic and the corresponding p-values of the Clark and West (2007) test of equal predictive ability. Values for the whole forecast evaluation sample (January 1985 – December 2010) are reported for the sake of comparison with the results reported in Rapach et al. (2013, Table VII, columns (2) and (5)), as well as sub-periods defined by the recessionary and expansionary phases of the US business cycle according to the NBER chronology.

On the basis of Table T 1 several observations can be made. First, the findings of Rapach et al. (2013) were reproduced exactly. At a 10 per cent significance level, in nine out of 10 countries the predictive model augmented with the lagged US stock returns yields a statistically significant reduction in MSFE relative to the historical average model, according to the test of Clark and West (2007). Only for the United Kingdom the null hypothesis of equal predictive ability cannot be rejected. The estimated country-specific R2OS is between -0.685 for Australia and 3.805 for the Netherlands. As mentioned in Rapach et al. (2013, p. 1656), six of the R2OS values are above one per cent and thus can be interpreted as “economically sizeable”.

Second, the comparison of the R2OS values reported for recessions and expansions reveals a striking difference both in terms of their magnitude and range. For recessions, the R2OS takes values in the range between 4.275 for Japan and 13.152 for the Netherlands, and for expansions the range is between -3.058 for Australia and 0.698 for Sweden. None of the reported R2OS values for the expansionary period is above one per cent, implying that also those that are positive cannot be interpreted as “economically sizeable”. The Clark and West (2007) test statistic is significant at the five per cent level in nine out of 10 countries for recessions, rejecting the null hypothesis of equal forecast accuracy in favour of the model with the lagged US stock returns for these nine countries. On the contrary, the null hypothesis of equal forecast accuracy can only be rejected at the 10 per cent level during expansions for Sweden and Switzerland.

These results lead to the following conclusions: There is a strong asymmetry in the predictive ability of the lagged US returns during recessions and expansions, with most evidence supporting predictability of international stock markets found during recessions. During the periods of US expansions, there is very little, if any, statistical evidence on the superior forecasting performance of the model augmented with lagged US stock returns over that provided by a historical mean model. We conclude that the evidence reported in Rapach et al. (2013) is fragile with respect to the forecast evaluation period. The results are more in line with those of Welch and Goyal (2008).

References

Campbell, J. Y. und S. B. Thompson (2008). Predicting excess stock returns out of sample: Can anything beat the historical average? Review of Financial Studies 21(4), 1509–1531.

Clark, T. E. und K. D. West (2007). Approximately normal tests for equal predictive accuracy in nested models. Journal of Econometrics 138(1), 291–311.

Rapach, D. E., J. K. Strauss, and G. Zhou (2013). International stock return predictability: What is the role of the United States? The Journal of Finance 68(4), 1633–1662.

Siliverstovs, Boriss (2016). International Stock Return Predictability: On the Role of the United States in Bad and Good Times. KOF Working Papers, (2016) Zürich: ETH Zürich, KOF Swiss Economic Institute

Welch, I. und A. Goyal (2008). A Comprehensive Look at The Empirical Performance of Equity Premium Prediction. Review of Financial Studies 21(4), 1455–1508.

You can find the KOF Working Paper «International Stock Return Predictability: On the Role of the United States in Bad and Good Times» by Boriss Siliverstovs here.

Contact

No database information available