Swiss Companies Set to Invest More

- KOF Bulletin

- Surveys

In 2018, Swiss companies plan to increase their investment activities by around 8%. Remarkably, they intend to step up expansion investment as well as capital investment. These lively investment activities also reflect the healthy state of the Swiss economy.

After the appreciation of the Swiss franc in January 2015 had placed a significant strain on the Swiss economy, the situation largely recovered in 2016. Despite the currency appreciation and the associated loss of competitiveness, Switzerland’s GDP expanded by 1.2% in 2015. In 2016, GDP grew by 1.4%. According to the KOF Economic Forecast of December 2017, Swiss economic output is expected to have grown by 1% last year. However, momentum should be much higher this year, with the current KOF forecast projecting 2.3% GDP growth for 2018.

There is a strong correlation between the investment trend and the GDP development. Typically, investment activities increase faster in times of economic growth than in times of economic weakness. In the last three years, capital investment oscillated around the longer-term average, similar to the GDP trend. On a price adjusted basis, capital investment increased by 2.2% in 2015, 3.1% in 2016 and 2.3% in 2017. In comparison, the average capital investment growth rate in the period 2004 to 2014 was around 2.2%.

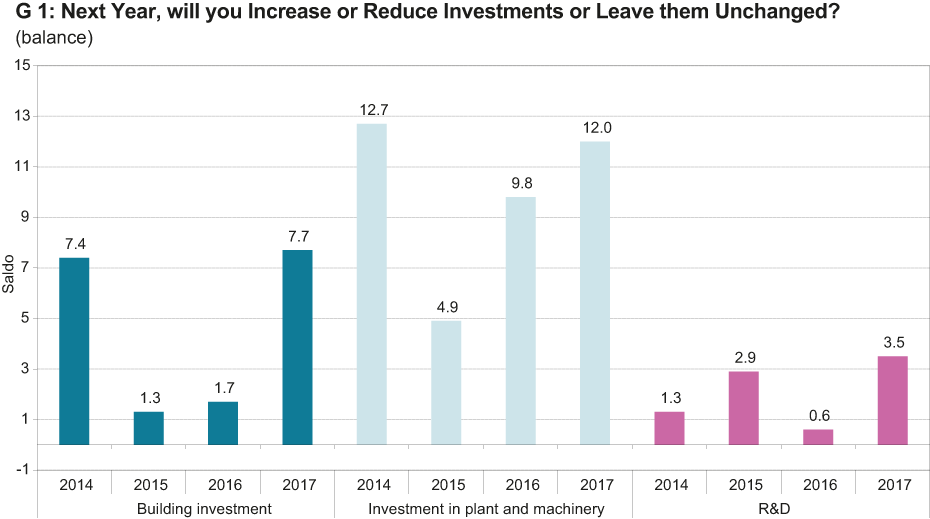

The latest KOF Investment Survey provides the first appraisal of expected investment activities in 2018. According to the survey results, nominal growth of capital investments will amount to approximately 8%[1] (2017: 8.5%). The qualitative statements given by the respondents also confirm a higher propensity to invest. In response to the question whether they intend to raise or reduce their investments in plant and machinery compared to 2017, or leave them unchanged, 29% of the companies stated that they would increase investments in plant machinery in 2018. 16% of the respondents indicated that they would expand their building investments in 2018. In comparison, around 16% of the respondents plan to reduce their investments in plant and machinery, while 8% intend to reduce their building investments. Graph G 1 presents the balance of the respective question for the last four years broken down by investment type. It shows that autumn 2014 was the last time the companies were similarly confident about their investment activities.

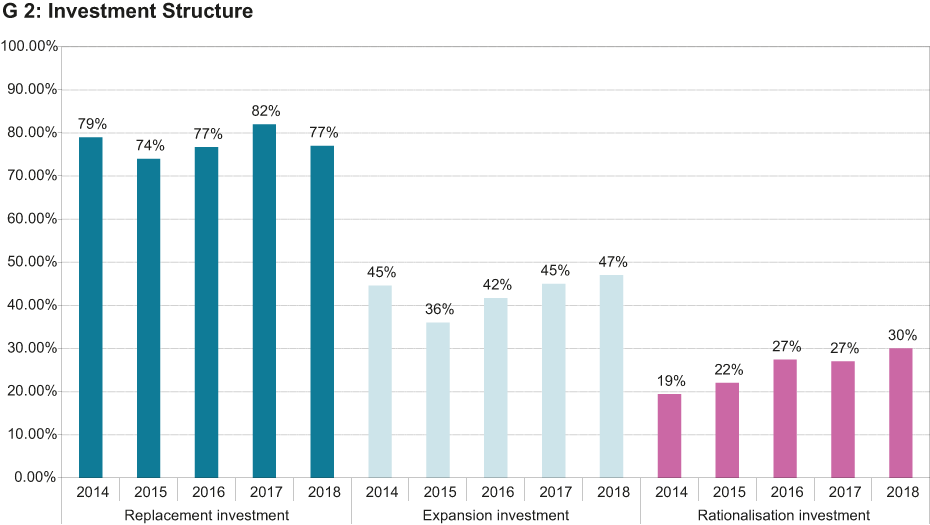

Graph G 2 presents the proportion of companies that made replacement, expansion and rationalisation investments in the last five years. While the percentages between 2014 and 2017 relate to realised investments, the figures for 2018 show the percentages relating to investment projections. Some investments are not necessarily limited to a single category and can, in extreme cases, be assignable to all of the listed investment types.

From an economic perspective, the different investment categories do not have the same relevance. As suggested by their name, pure replacement investments serve to replace existing plant and machinery and do not impact on the economy’s production capacity. By contrast, expansion investments are of central importance to the future development of the economy. On the one hand, they raise the capital stock and hence production capacity, on the other, they can serve as an indicator of companies’ expectations. In weak economic phases with a negative outlook and high levels of uncertainty, companies tend to hesitate before expanding their production facilities and frequently restrict themselves to replacing existing machinery. During optimistic phases, however, companies expect rising demand and expand their capacities to meet this extra demand.

According to the KOF Investment Survey, over 47% of the surveyed companies plan to make expansion investments in 2018, which reflects rising optimism among the enterprises. A substantial portion of the budgeted 8% rise in capital investments is likely to go into the expansion of existing capacities and will thus raise Switzerland’s total production potential. Aside from expansion investments, this year should also see a rise in rationalisation investments. Companies engage in this type of investment to replace existing production facilities with more efficient ones and attempt to raise their competitiveness via more productive plants.

[1] The rates of change in the survey results reflect the capital investments made by private companies in Switzerland. Agriculture, private households and semi-public enterprises were not, or not fully, included. The rates of change are thus not directly comparable with the NA rates.

About the KOF Investment Survey

The current KOF Investment Survey was conducted among a panel of over 8,000 companies chosen to reflect the structure of the Swiss economy. The public sector, semi-public enterprises and private households are not included in the calculation of the investment figures. A total of 3,000 companies responded.

Contact

- Location location_onLEE F 128

- Phone phone+41 44 632 70 36

- Emailemaildibiasi@kof.ethz.ch

- contactsvCard Download

Professur f. Wirtschaftsforschung

Leonhardstrasse 21

8092

Zürich

Switzerland